(ThyBlackMan.com) There were a lot of important economic stories over the past month. Inflation continued to drop. Unemployment stayed low. The Federal Reserve kept interest rates steady. The stock market rebounded. And consumers, who have never been better off, complained about the economy and took it out on Biden. But the biggest story of all is the recession that did not happen. We want to take a quick look at all different areas and what the changes mean for Black folks.

The Recession that did not happen

Many economists, Wall Street investors, and media outlets predicted a recession in 2023. They believed a “small” recession was necessary to reduce inflation in the economy. Media outlets on the right were running a constant stream of inflation complaints trying to make President Biden look bad and possibly cause a recession during the 2024 election year.

A Recession is when the economy actually shrinks. The effect is widespread throughout the economy and affects most industrial sectors. People lose their jobs. Consumer spending slows and corporate profits fall. People lose their homes. Recessions are far worse than inflation. The last recession was the “Great Recession” in 2008 when the economy contracted by about 4.3%. It was the largest and longest recession since the great depression. The recession was caused by unethical real-estate lending practices.

During the last recession, about 1.3 million Black people lost their jobs and the official Black unemployment rate soared to 17%. The real Black underemployment rate was closer to 25%. Black homeownership dropped from 48% of Black families owning a home in 2007 to 41% in 2016. In other words, 15% of Black people lost their homes during the recession. Why would anyone want that?

What really happened this time?

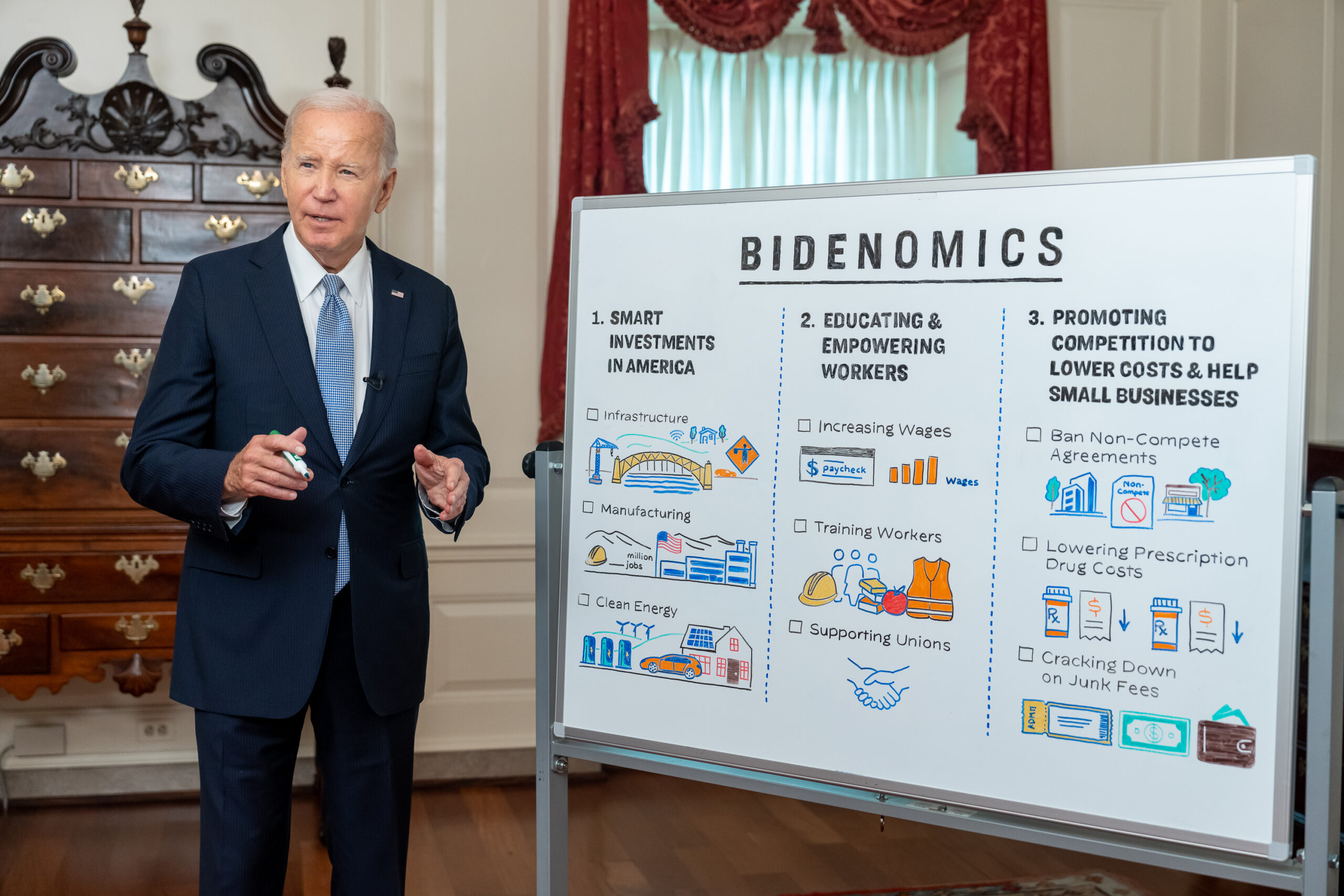

Recessions are partially fueled by psychology and fear. If I think I am going to lose my job, I stop spending. When many people stop spending, consumer demand plummets and more people are afraid of losing their jobs. The whole thing can snowball unless someone steps in to create demand or lower interest rates. And that’s exactly what happened, the Fed and Congress stepped in. The Federal Reserve has carefully managed interest rates (monetary policy) while constantly talking about being tough on inflation. In addition, the government was able to spend money at the right time (fiscal spending) through bills like the Inflation Recovery Act. This fiscal spending added demand to the economy. In the remarks from the last Federal Reserve meeting, Americans have adjusted to higher prices while enjoying higher wages.

Note: The author got laid off during the last recession, so I am way more concerned with keeping a job than the price of an egg or a gallon of gas.

Other news on Employment, Inflation, Mortgage Rates and Politics

Employment had a great report in November. The economy created 199,000 new jobs. The official unemployment rate dropped to 3.7% and wages grew at a 4.0% annual rate. The Black unemployment rate was 5.8%, among the lowest ever, and 20.8 million Blacks are currently working. Blacks are 1.5x times more likely to be unemployed than Whites, but the record-low Black unemployment rate means three things: It’s a great time to ask for a raise, it’s a good time to look for a new job and it’s time to move to a higher-paying field like cyber security, nursing or teaching. Note: The autoworkers union ratified a new contract with 25% raises over 4 years setting a national standard for wage increases.

The inflation rate dropped to 3.0% during October as compared to a year ago.

The average 30-year mortgage interest rates dropped below 7% (6.95%) and 10-year Treasury bonds fell below 4% (3.915%). As inflation cools down, the mortgage interest rate will also drop. Housing prices have continued to rise by 3.4%. Owning real estate is one of the best investments Black people can make. Now is going to be a good time to look at owning real estate.

The stock market rebounded since October as indicated by the S&P 500. Corporate profits had flat growth but stayed near record highs ($3.1 Trillion Dollars). High corporate profits are good news for investors and retirees and bad news for consumers and workers. Those profits do not come magically out of thin air. Profits come from somewhere: your pocketbook when you buy something or your paycheck when you go to work. However, if you are a Black investor, the steady increase in corporate profits will increase your investment returns.

And finally, even though the economy is performing better than average, Joe Biden continues to poll badly on the economy in key states.

Conclusion

This may be the first time the economy has managed a “soft-landing,” since I have been studying economics. Timely spending by Biden and Congress and great interest rate management by the Federal Reserve provide a “soft-landing” for the economy while reducing inflation. Let’s hope we learn from this lesson and the good management of the economy continues.

Written by Chris Lee

Official website; http://www.BlackEconBiz.com

Leave a Reply