(ThyBlackMan.com) In his January 1964 State of the Union address, President Lyndon Johnson proclaimed, “This administration today, here and now, declares unconditional war on poverty in America.”

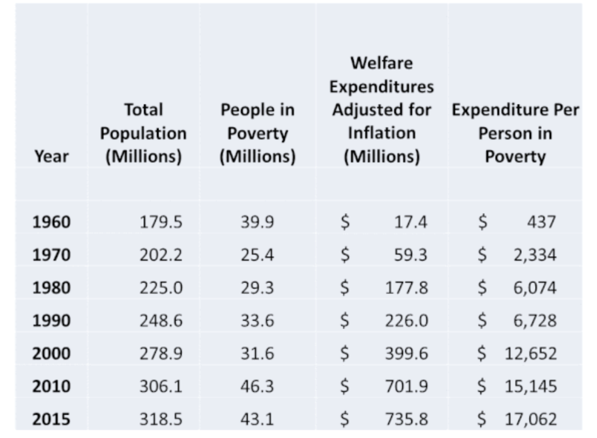

In the 50 years since that time, U.S. taxpayers have spent over $22 trillion on anti-poverty programs. Adjusted for inflation, this spending (which does not include Social Security or Medicare) is three times the cost of all U.S. military wars since the American Revolution.

Progress against poverty, as measured by the U.S. Census Bureau, has been minimal. The War on Poverty has been a colossal failure. A significant portion of the population today is less capable of self-sufficiency than it was in 1964.

Majority of the root causes are beyond my ability to intelligently write about. The major root cause I will discuss is the lack of financial literacy in minority communities, which have kept minorities at the fringes of investing in the stock market, real estate, entrepreneurship, etc. Which is why I believe pouring more good money on bad meets the definition of stupidity. Stupidity is doing the exact same thing but expecting different results!

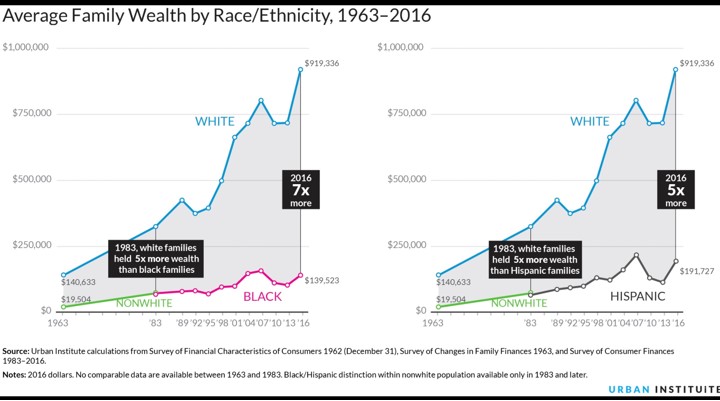

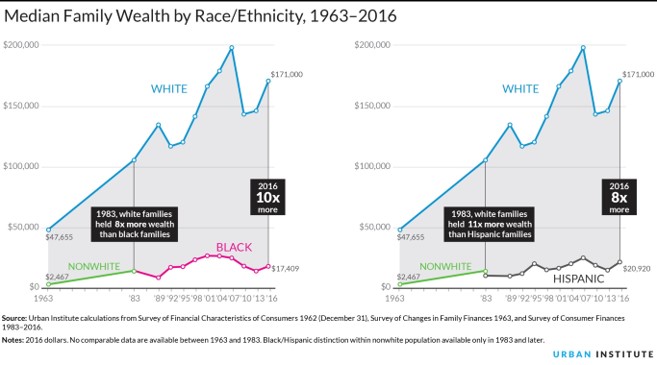

FAMILY WEALTH GAPS BY RACE – 1963 02016

The above charts show the average and median wealth by three races in the US from 1963 to 2016. Both charts indicate a worsening in the wealth gap for US African Americans and a slight improvement for Hispanic Americans.

Several of today’s politicians are proposing reparations to the ancestors or slavery. I do NOT believe this will occur nor do I believe based on the $22 Trillion spent to date, this will significantly close the gap over the long run.

THE TRUE COST

The US Federal budget is ~$4 Trillion dollars and Welfare Expenditures in 2015 was ~$736 Billion or ~18.5% of federal spending. Even with 18% of the taxpayer’s money, to many Americans continue to be left behind.

- Forty percent of Americans make less than $15 an hour.

- Forty percent of Americans can’t afford an unexpected $400 bill, whether it’s medical or fixing their car.

- Fifteen percent of Americans make minimum wages,

DEFINING FINANCIAL LITERACY

Text Book Definition: “Personal financial literacy is the ability to read, analyze, manage, and communicate about the personal financial conditions that affect material well-being. It includes the ability to discern financial choices, discuss money and financial issues without (or despite) discomfort, plan for the future, and respond competently to life events that affect every day financial decision, including events in the general economy.” Ok-what on earth did that long sentence say?

Plain English definition: Financial literacy is the understanding of money, how it is spent and saved. Financial SUCESS/WEALTH BUILDING is achieved by spending money carefully, saving CONSISTENTLY and investing WISELY!

Financial literacy allows you to answer questions like:

- Do you want a fixed-rate, adjustable-rate, interest-only or FHA mortgage?

- Should you claim the standard deduction on your taxes or itemize?

- If your company’s 401-K plan does not match should you contribute to that plan or an IRA/ROTH-IRA?

- How much do you need to safely retire?

When I first came out of college with a BS, my financial literacy grade was somewhere between a D and F. When some work peers asked me what type of CD’s I owned, I replied Michael Jackson’s (Favorite song-Thriller!). Embarrassing moment (not my last) -they were referring to Certificates of Deposits (CDs). Hum- maybe I was an F grade at Financial Literacy!

In the US, most people gain their financial literacy from their parents and sometimes our spouse/significant dating others. However, if your parents have little financial literacy, what did they teach you? I certainly was not taught at home about the stock market, 401-K plans, IRAs, The “Magic of Compound Interest”, Warren Buffet, Peter Lynch, Mutual Funds, etc.

DOES PUBLIC EDUCATION TEACH FINANCIAL LITERACY?

Typically our elementary, Middle and High Schools teach absolutely ZERO, about financial literacy. One state has just proposed making this a mandatory subject in High School. I hope others will follow!

COLLEGES MUST TEACH FINANCIAL LITERACY-RIGHT?

You might think colleges teach students financial literacy. Let me ask – if you understand finance literacy would you borrow greater than $100,000 to get a degree that IF you are lucky enough to find a job you may earn $21,000? Colleges unfortunately not only do not teach financial literacy, but also in my opinion take advantage of those who lack financial literacy and sell useless degrees.

I can tell you as a nerd/geek, with four degrees, the last from Harvard Business School, I gained majority of my financial literacy from my Mom, Uncle, Brother, Work Mentors, and LOTS of reading (that nerd thing actually came in handy!). A large percentage of college courses teach you absolutely NOTHING that will prepare you for the real world and assist you in building wealth. I am not against further education, but I am disappointed colleges do not offer a MANDATORY Financial Literacy Course. They did force me to take four physical education courses, however. Go figure I’m still FAT!

Risk Adversity And The Racial Wealth Gap

A 2015 survey asked Americans with household income of at least $50,000 whether they owned stocks or stock mutual funds. Eighty-six percent of whites said -Yes. For African-Americans, the number was 67%. Among Hispanics, the survey found that 47% of participants would prefer to place money in no-risk savings accounts (which fail to keep up with inflation, in other words they are losing purchasing power), rather than in ETFs, Mutual Funds, REITs, Stocks, etc. That compared with 35% for U.S. investors overall.

Investing in stocks will NOT guarantee wealth. In fact, WITHOUT financial literacy/competency you are most likely wasting money! Investing beyond a savings account or your home is an important element of building a healthy retirement plan. Healthy retirement plans, will narrow the racial wealth gap.

CONCLUSION- HOW DO WE FIX THE PROBLEM

All the above data tells us: “Houston We Have A Problem”. We have shortfalls in the public and college educational system in preparing people for the real world. Making progress against these issues involves schools, companies and local organizations to provide the necessary financial literacy skills. We can teach financial literacy in Houses of Worship, Girl Scouts, Boy Scouts, Workplaces, Clubs and many other places. We are making a mistake ignoring financial literacy/competency. If we do not step up and address this, society is going to get worse, because these problems are NOT going away. In fact, the retirement problem in the US is getting worse. We pay one-way or the other.

Next week, I will continue discussing Financial Literacy and tools you can utilize at home at your own pace, to improve and BUILD YOUR WEALTH.

ALL COMMENTS, RECOMMENDATIONS AND FEEDBACK ARE WELCOME. SEE BELOW LEAVE A REPLY SECTION.

PLEASE SIGN UP TO FOLLOW THIS BLOG by clicking AT THE TOP OF THE HOME PAGE: FOLLOW BY EMAIL

ALL LIKES ARE GREATLY APPRECIATED!

DISCLAIMER

I am a proud nerd (my beautiful wife and daughter told me so) investment and finance blogger, with University Rutgers, MBA and Harvard University, Advanced Management education.

I started my first business at ~13 years of age. I am a successful investor in equities and real estate and happy to share my personal finance and investment lessons learned with you. I am NOT however, a licensed financial advisor. Please do not construe my suggestions on this blog, as recommendations for your personal situation. For individual finance advice please seek your own licensed CPA or financial advisors.

Staff Writer; Styron Powers

One may visit this brother over at; Powers Investments Management and also connect via LinkedIn; S. Powers.

Leave a Reply