(ThyBlackMan.com) As the world has grown closer through the internet; our shared concerns as Americans, regardless of race, have also brought us closer together. With a looming economic slow-down on the horizon, working class blacks and whites, have the same issues in common; job security, money and health care cost, with money being the overriding issue.

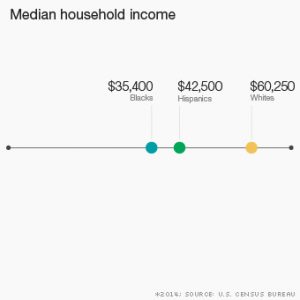

Thus, what is good for blacks, is also good for whites and the rest of America. We are fighting the same battle, and that battle is income inequality, which doesn’t create division, based on race. It is a battle of the have and have-nots, with more than an ample number of blacks taking positions, in the opposing camps of the “haves.” Granted, blacks as a group, are more affected, when it comes to income inequality, but this detail doesn’t negate the fact, whites are impacted, as well.

Therefore, the overriding question becomes, what should black people support politically, as a group, that will move the ball down the field economically for them, while also advancing America, economically? Results are important, when it comes to supporting any initiative of substantive change.

The U.S. economy is declining. GDP is projected by the Federal Reserve to be 1.9% in 2020. 3% GDP prior to the 2008 Great Recession was the norm. That being the case, any reading below three percent represents a failing grade, when it comes to the economy.

Blacks will bear the brunt of any economic downturn, as the 1st worker group to be laid-off. It is time for A Consumer Tax Cut, which makes good economic sense. A Consumer Tax Cut plan would raise America’s GDP beyond 3%, expanding economic opportunity and income; “proactively,” impacting poverty and lay-offs.

A Consumer Tax Cut is not just good for Black America, but it is good for America. In fighting for the cause of America, we fight for ourselves. This doesn’t mean, blacks don’t have problems, which are unique to the black race. What it does mean is, we shouldn’t be blind to an opportunity, that works for us and works for America, as well.

“REFORMING CAPITALISM,” as currently practiced in America, is in our best interest, to facilitate A Consumer Tax Cut. It is an idea, whose time has come. When the federal government gives consumers, who are 70% of our Economic Pie, a Tax Cut, this creates income across our nation.

Economic growth begins, when you spread the wealth of America’s economy. Just like rainfall to a barren desert, A Consumer Tax Cut, will cause green economic shoots to sprout nationwide, including green economic shoots in communities of color.

Baby Boomers, who would be the targeted group of such a tax cut, include an equitable number of the black population. They are retiring at a rate of 10,000 per day. Hand our retirees a 10% tax cut of approximately $25,000.00 and reform this capitalistic economy.

Why use Baby Boomers as the core of a tax plan? Boomers have children and grandchildren, most affected, when it comes to income inequality. By targeting Boomers, you touch most of the entire, 327 million American population! Boomers are the most dependable voters in the nation. They will affect the outcome of the 2020 elections.

How do all Americans benefit? They benefit, if the tax cut plan is continued beyond the ten years the tax cut legislation will be initially written for; to have it enacted into law. And, if I were a betting man; once the law is enacted, it will become permanent and extended to future retirees.

Why is this, so doable? The math is on America consumers’ side. Go to a calculator in the computer and Do the MATH, yourself. 10,000 Boomers per day RETIRING times $25,410.00 = $254,100,000.00. 365 days times $254,100,000.00 = $92,746,500,000.00, annually. 10 years times $92,746,500,000.00 = $927.5 billion, over 10 years.

Where, the Trump $1.5 Trillion Tax Cut to the rich, fail to grow the economy, the Boomers’ $927.5 Billion Tax Cut will succeed, because consumers, as I said, are 70% of this nation’s economic growth story. If consumers stop spending money, the economy goes into a ditch.

There you have it, an economic opportunity is knocking at the door. Money is money, whether it’s gotten through reparations or a consumer tax cut. It all, spends the same!

This “Direct” Consumer Tax Cut, is an opportunity for one generation, the Baby Boomers (1946-1964), to leave a legacy of reformation to America’s capitalist system, that will benefit and be felt financially, by future generations, Generation X (1965-1980); Millennials (1981-1996); and even Generation Z (1997-2012), when it comes to income inequality.

For the details and supporting information, in defense of A Consumer Tax Cut and much more, see “The Fix This Time.” That said, A 10%, $25,410.00 Consumer Tax Cut can be ours…, if we want it.

Finally, to incrementalists who say, “America is not ready for this!” and some of you, who feel A 10% Consumer Tax Cut is, “a bridge too far,” here is an irrefutable history lesson. We have had 50 years of 3rd party social service programs. However, millionaires, billionaires and corporations have had, “FIVE direct tax cuts,” since 1980, ultimately resulting in the slow economic growth and income inequality, we are currently going through.

During, the same period of time, there have been “ZERO direct tax cuts,” given to consumers. Retirees and consumers want what millionaires, billionaires and corporations get in tax cuts; money handed to them directly, so they can determine how its spent.

The fact, that the majority of America’s wealth has been pushed up to the top 10-20 percent of our population, intensifying income inequality, due to political policies and tax cut decisions favorable to millionaires, billionaires and corporations, should not surprise us. This is what wealthy individuals, businesses and corporations set out to accomplish and they have been very successful, as this is our new economic reality, which can be changed, with A Consumer Tax Cut. When Consumers increase spending, “the profit” of America increases. Capeesh!

Staff Writer; James Davis

Mr. Davis is a leading expert and consultant in Financial Analysis and Social Dynamics. He is a graduate of Florida A. and M. University (FAMU), a former stockbroker, and a human rights activist who resides in Sanford, Florida. He was awarded the prestigious Governor Haydon Burns Scholarship to attend FAMU and while at FAMU was awarded the first Martin Luther King Scholarship. He is the author of three books, among them is “The Fix This Time,” Boost Your Retirement Income! Simultaneously Create Jobs and Spur Economic Growth (https://www.amazon.com/dp/B00MI3PD2M).

Mr. Davis can be reached through his blog @ https://thefixthistime.com.

Leave a Reply