(ThyBlackMan.com) Employers and the EEOC may be heading for a confrontation over the use of credit ratings in hiring.

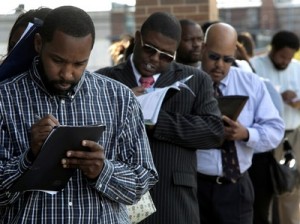

It’s a cruel irony of life that, as Billie Holiday sang, “Them that’s got shall get,” but practices in today’s job market suggest that those in the best position financially have a better chance of being hired to fill the limited openings available. That’s because credit checks are increasingly becoming a standard practice for employers. Thirty-five percent of employers admitted that they checked applicants’ credit in making hiring decision in 2003. It’s believed that the percentage of employers relying on credit checks has  increased dramatically in the two years since the onset of the nation’s economic crisis. This means that those who most need a job — unemployed men and women who have fallen behind in home or car payments — may be less likely to be hired than similarly qualified, but financially secure, applicants.

increased dramatically in the two years since the onset of the nation’s economic crisis. This means that those who most need a job — unemployed men and women who have fallen behind in home or car payments — may be less likely to be hired than similarly qualified, but financially secure, applicants.

The fact that African Americans, women, the elderly and other economically vulnerable populations have been hardest hit by the collapse of the economy means that the use of credit reports as a gatekeeper to employment may also violate federal laws prohibiting discrimination in employment.

Now Jacqueline Berrien, the new chair of the Equal Employment Opportunity Commission (EEOC) — the federal agency charged with monitoring discrimination in the workplace and authorizing employment-discrimination suits — has decided to review the use of credit checks by employers. At recent hearings, the commission heard testimony from advocates, employment-discrimination lawyers and representatives of employer organizations about the increasing use of credit checks in hiring decisions.

The practice of using credit checks has drawn protests from many consumer agencies and advocates, who argue that a prospective employee’s credit history should be off-limits to prospective employers. As Chi Chi Wu of the National Consumer Law Center explains, “You can’t re-establish good credit if you can’t get a job, and you can’t get a job if you’ve got bad credit. Dr. Avis Jones-Deweever, executive director of the National Council of Negro Women, cites a study showing that African Americans are 27 percent more likely to have negative credit histories. She also notes that credit reports often include incorrect and outdated information.

Representatives of the U.S. Chamber of Commerce have suggested that concerns over the use of credit reports are overblown. They argue that credit checks provide employers with valuable information. But there is little evidence to support the chamber’s reassurances, and it’s hard to see how credit reports can tell employers much of anything relevant to employment in most cases.

A young person’s excellent credit report may simply be an indication that he or she has a parent wealthy enough to pay his or her credit card bills and car payments. The more desirable employee may be the young person who — although behind a payment or two — takes full responsibility for his or her life. Indeed, the chief industrial psychologist for the EEOC testified that information in credit reports provides almost no reliable indication of how a prospective employee will perform.

For jobs involving access to large sums of money or others that involve fiduciary responsibilities, credit checks may be appropriate. But some employers use credit checks on the theory that good credit constitutes evidence of a prospective employer’s trustworthiness, even though there is no empirical evidence to support the theory that those with bad credit are more likely to steal from employers or to engage in other acts of malfeasance on the job. This means that credit checks are becoming just another barrier to employment for those most in need of work.

The potential racial implications of credit checks as standard hiring practice should not be dismissed as overblown. The U.S. Chamber of Commerce calls credit checks “just one piece of the puzzle” in hiring. But it’s a piece that seems particularly open to arbitrary application. It’s worth remembering that employers have been shown to discriminate against applicants based on factors as irrelevant as having a “black-sounding name.”

If having the name “Emily” can yield 50 percent more interview callbacks than someone named Lakesha receives, and living in a wealthy neighborhood rather than a modest or poor one increases an applicant’s chances of getting an interview, as a 2004 study showed, it’s plausible that an applicant with a perfect credit history stands a better chance of being hired than one who is behind in her credit card payments. If, as that same study showed, having a “white-sounding” name is the equivalent, for interview purposes, of having an additional eight years’ experience, then how many experience years are added to the application of the prospective employee with a perfect on-time payment record?

It’s unclear when or whether the EEOC will take action against the use of credit checks, but in the meantime, state legislatures have begun proposing legislation to outlaw the practice. Illinois and Oregon have already forbidden the use of credit checks by employers. Voters in nearly a dozen other states have begun rallying support for similar legislation. But credit bureaus and business groups are pushing back, fighting to continue using credit reports to decide who is worthy of working and who is not.

Written By Sherrilyn A. Ifill

This is really an informative article! Thanks!!!