(ThyBlackMan.com) Not gonna be too many supported links in this piece, just a written reflection of my fury.

I have taught and said a few things to my kids as they were growing up. First, someone has to be number one, may as well be you. Second, if you do not control your mind, someone else will. Three, if you want to hide something from a black person, put it in a book, and last, money is to make money and not to spend. All of the above were told to me by members of my family. Never realized I listened to what my elders told me but I did.

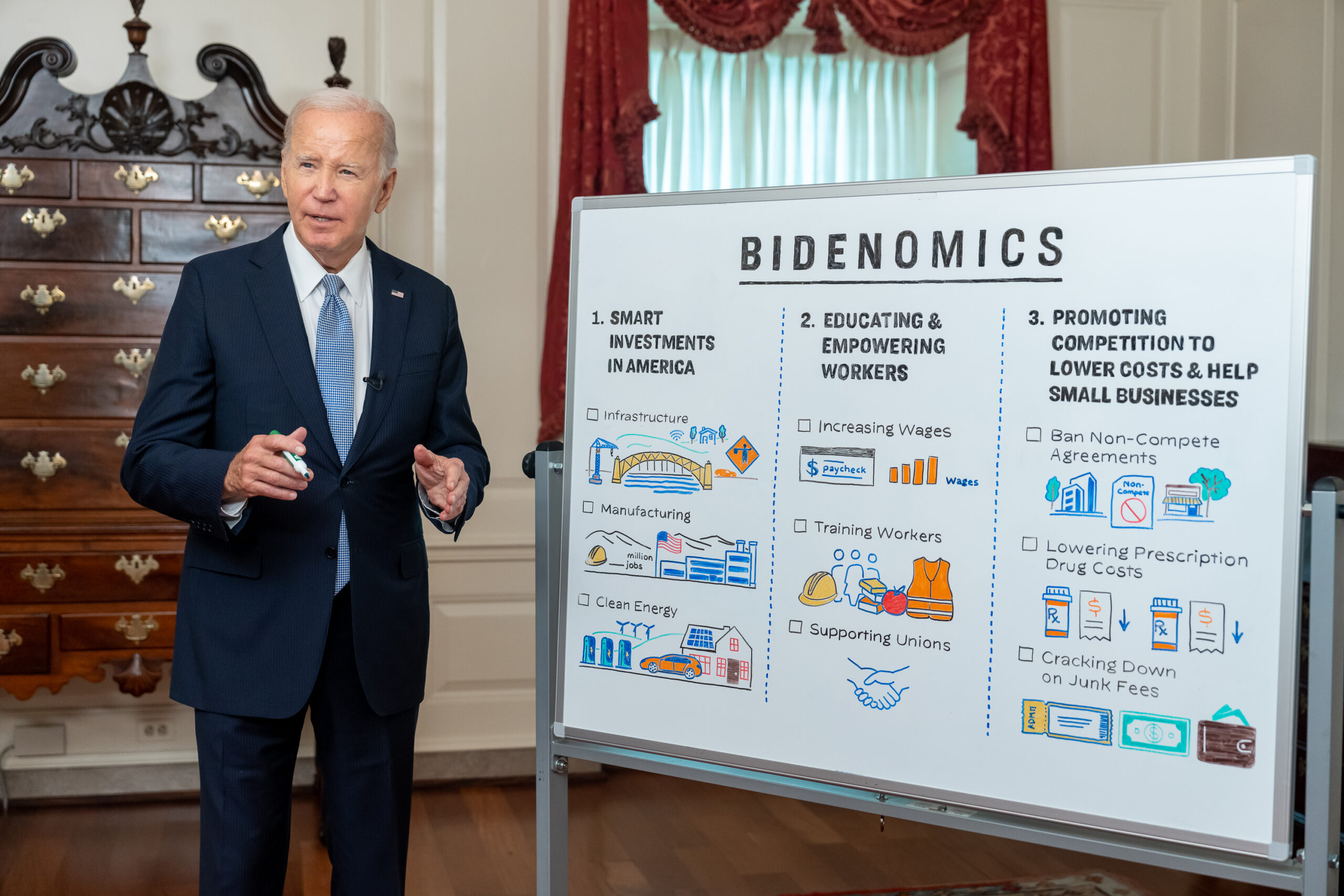

I always say you get what you vote for. Unless your monkey azz been out of the country or under a rock the Biden Administration has just proposed a 44.6% capital gains tax in his Fiscal Year 2025 budget proposal. If passed, this would set a new record for the highest federal capital gains rate ever, at least since 1922 from what I could find. I own land and a lot of crypto, so this concerns me. So hey sane people, thank the crazy Biden Voters for this. By my math, this suggested tax rate, in concert with state taxes, would end up with a composite tax rate above 50% in some states, in California, a rate as high as 59%. I told folk Bidenomics was jacked a while back. The real humdinger is Biden’s proposed 25% tax on unrealized capital gains.

So if put into effect, this proposal would have a way higher top capital gains tax rate than many other countries like China, which could abrogate any competitive position we have as a nation to attract and retain capital investment.

Biden’s tax proposals could result in a stock market crash. It would be catastrophic for an already weak economy that is teetering on stagflation and possible recession. The only outcome will be the rich staying rich. Sure, they will just go on one less vacation and the poor people will become poorer and still won’t buy a house. This is amazingly backward.

Every time I think old JB can’t come out with a crazier plan, he proves me wrong. This scares the crap outta me. I make money and still have to budget how much I eat because everything is too expensive and now if I squirrel a little away to invest I may pay for assets I don’t even have. Joe is not worried cause the president doesn’t have to pay taxes while in office and after he leaves. This is just additional geometric proof of why we need a businessman as president.

Great way to lose more votes! In that way, it’s a win. Because if he gets re-elected then we are just asking for this. Need I remind you, that America went to war over a tea tax among other issues?

Let me attempt to break this down. Capital gains taxes came into existence in 1922 with a rate of 12.5%. Capital Gains taxes are paid on gains after you sell an asset (usually a stock or bond, but also other assets). If they want to tax the “gains” before you sell the asset, this is outright ridiculous. You might just lose a ton of money overall. So if you have a rental and to make the same profit on your investment you will have to over double the rent?

Now all I know about economics outside of reading a few cats (Tomas Sowell, Milton Friedman, Karl Marx & Hjalmar Schacht) came from my 10th-grade Economics teacher, Dr. Moyer. What I learned in his class has stayed with me since 1977.

I would like to add that capital gains are not just stocks. This would also affect any vehicle, boat, or property you sell as well, and as I stated prior, they have not been this high since 1922 and we all recall what happened 7 years later.

Taking the proposed 25% tax on unrealized capital gains first. As a simple example, if you buy $25 worth of stock and it ends up being worth $100,000, under this Biden approach, even if you hold the stock and do not sell, you will owe the Federal Government $25,000. Mane, you got me fck up. This shit will bankrupt people that don’t sell. The capital gains proposal is no better, so you sell your house and make a $100,000 profit, $50,000 goes to taxes to pay for things like student debt forgiveness, pre-paid debit cards for criminal illegal aliens, and tanks for Ukraine. All of this is in an environment of Dragflation, where the economy is going down while inflation is going up.

I paid less in federal income taxes under Trump and that is a fact, not to mention, shit like this reminds me to keep stacking shiny metals and ammunition. The reason why Biden proposes such is even more ridiculous – Racism. According to his administration, current taxes regarding capital gains and unrealized capital gains are racist. Why? Apparently, it disproportionately benefits white people. To me, it feeds into the historic racist troop that White people are the only people that are smart enough to invest their money because we pitiful Negroes, Latinos, and Asians are too dumb to know any better or learn about investing. So instead of incentivizing people to do more to build wealth, individually and independently, we’re going to disincentivize economic self-empowerment and determination. This is insane. Are we as minorities broke and don’t invest in anything? I feel insulted because l do invest and my current crypto wallets are phatt. I know lots of Black folk who stack dough and diversify their loot.

The Biden administration as most liberal progressive cats want equality for everyone, which in their eyes means everyone should be equally poor. Except them. This is an easy desire when you’re a corrupt politician spending the money others worked hard for.

This also creates a barrier of entry for anybody looking to start investing, which is the gateway to financial independence. But no let’s keep the poor people on the government titty. If this is the approach they are taking, it just proves spending is past the point of no return with hyperinflation just around the corner.

They just did this in Canada. I’m guessing all the WEF leaders are planning on bumping up their game plan. Justin Dildeau (Pun intended) just dropped his budget for this year and he is proposing to increase Canadian capital gains tax from 50% (which is already ridiculous) to 67%. It is as if the message is that scrimping and saving and putting every dollar I can into some investment is futile and a bad habit. This proposal is designed to punish folk by putting them out on the streets for trying to better their future. Incredible.

Unrealized gain tax is crazy. Imagine being taxed on an asset that you didn’t sell. Take bitcoin. You buy it at 40k and it goes to 65k and then drops to 10k. If the cutoff is at 65k you will be paying tax on a 25k gain you never realized while your holding is at a 30k loss (which they most likely will not let you take.) A 44% tax on realized gains would lead to no investing. Biden doesn’t care because Biden doesn’t don’t have to pay taxes. I hope his rich donors never go for this.

Why not a 150% tax rate? We can be taxed for paying taxes and then pay tax of the remaining taxes not yet realized. Democrats are bringing back a new form of slavery with this tax proposal. Here’s an idea, why don’t we cut spending and free handouts? America has over 100 million people not working. The fact is that if you own a home you already pay unrealized capital gains tax by way of property tax. So if this becomes law those wealthy people will just leave the U.S. How do you recover that tax loss then? It would trickle down to everyone as they would have to raise taxes to make up for those losses.

There is no reason for all this taxation, we know the government is not good at handling money. Look at how much money they have given away to foreign countries. How about no. And on top of that, we need to cut thousands of useless government jobs. Stop sending our money to other countries and make it a straight 10% tax across the board. Honestly, who feels that the government is being wise with money? Why would giving them more make the situation better? Unrealized gains should never be taxed. That is a psychotic idea. Think about it, 44% tax on $10 this year leaves $5.54. Next year, that $5.54 becomes $3.07. Next year, that $3.07 becomes $1.70. This is all on UNSOLD investments. How long can this last?

The new world order wants no middle class. If you have ever seen futuristic, dystopian movies, the rich walled off from the poor people and there’s no in-between. How the hell are they going to tax unrealized gains? Are they going to give out tax refunds for unrealized losses? So punish people who work hard, save their money, buy homes, and invest their money wisely because other people are irresponsible and don’t do the same thing? I hate our federal government.

How the fck can a cat end up with a higher tax bill than any gains that you hold? Them 1776 folk had it right? Don’t commander my crib, don’t fck with my gunpowder, and don’t tax my earnings. All taxation to keep it real is a form of punishment. My query is do I deserve to be punished because I had a financial life plan, stuck to it, and it worked? Biden cannot understand who supplies the jobs or who works those jobs. They ignore those who have to save up money for retirement. If they do not comprehend any of the aforementioned, they can miss me with that foolishness. I would instead advocate to stop paying taxes then.

Staff Writer; Torrance T. Stephens

Can also purchase any of his books over at; Amazon – TTS Books.

The article certainly delivers a passionate critique of Biden’s proposed capital gains changes, but it unfortunately seems to prioritize fiery rhetoric over substantive analysis or factual accuracy. The discussion could benefit greatly from supporting data and a more balanced examination of the economic principles involved. Moreover, the personal anecdotes, while engaging, do not substitute for a thorough understanding of the complex fiscal policies being debated. It would enhance the credibility of the argument if it included more diverse perspectives and avoided overly simplistic conclusions about such a multifaceted issue.

It’s good to see someone criticize Joe Biden and his administration. It’s shocking how Congress lets him harm the nation. His administration seems to only focus on spending money, yet nobody is addressing the increase in taxes and other issues.

Your passionate reflection on the proposed capital gains tax changes underscores a deep concern about the economic implications and fairness of such policies. You’ve highlighted how these changes could discourage investment and disproportionately impact those who have strategically planned for their financial futures. The frustration with the idea of taxing unrealized gains is palpable, as it challenges fundamental principles of taxation and investment.

Your critique extends to broader issues of government spending and fiscal responsibility, questioning the wisdom of increasing the tax burden on productive sectors of the economy. This reflection clearly voices a call for reconsideration of the approach to taxation, suggesting a need for policies that encourage economic growth and personal financial independence rather than punitive measures that could stifle both.