(ThyBlackMan.com) Recent developments in the banking sector have not only been marked by failing institutions but also by significant activity among Black-owned banks. A Black-led investor group’s plan to acquire a bank in Utah is just one unexpected example, accompanied by the emergence of four proposed or newly identified Black banks and three credit unions. This surge in activity over the past three months exceeds what we’ve observed in the last decade.

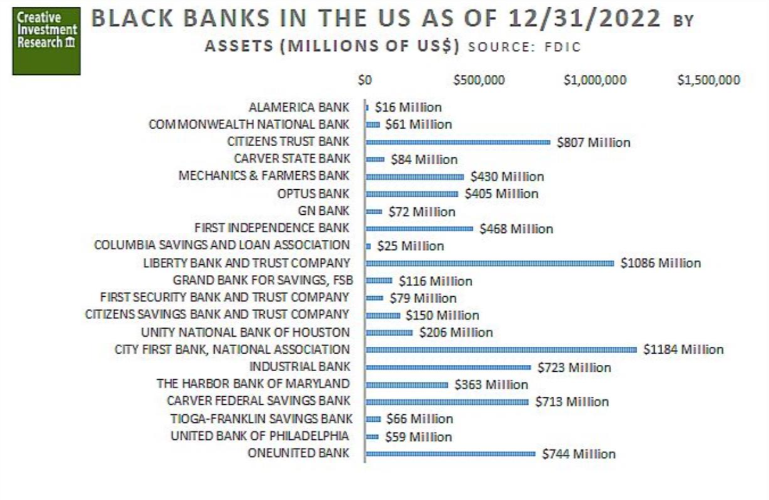

The growth in potential Black banks and credit unions may be attributable to the $70 billion pledged by foundations and corporations for racial reconciliation efforts following the George Floyd incident. Despite these developments, the long-term presence of Black banks and credit unions remains limited, with only 21 Black banks and 33 Black credit unions in existence. Even with recent proposals for new Black-owned banks and credit unions, their overall impact remains minimal due to their small numbers.

In 2019, I highlighted that banking regulators have historically neglected the needs of the Black community and, consequently, the nation as a whole. One proposed solution is for the Federal Reserve to create a Black bank liquidity pool. While the $50 billion proposed at that time was initially deemed excessive, non-Black banks have been granted $134 billion in various liquidity and financing programs, demonstrating the potential for substantial support when a problem is taken seriously.

Even a $5 billion Black bank funding pool could significantly bolster this rapidly growing sector, with a focus on purchasing treasury’s, mortgage-backed securities, Small Business Administration and Minority Business Development Agency-issued loans or loan guarantees from verified Black-owned banks. This $5 billion initiative could yield an estimated $45 to $50 billion boost, benefiting both the Black community and the U.S. economy. We should expect the program to have a higher-than-average impact given the capital-starved nature of the community served.

I first suggested this approach in 1994 at the Federal Reserve Bank of Kansas City. Since then, the Fed has responded to numerous crises by purchasing trillions in securities to support banks and other financial institutions, predominantly owned by nonminority individuals. However, Black-owned banks have often struggled to receive the same level of support. This differential may have resulted from unintentional disparate impact in policies and programs, like the Basel Framework, and the Fed’s liquidity facilities. These facts support the creation of the targeted liquidity pool.

If a Fed liquidity facility specifically for Black banks is unattainable, an alternative might be a loan guarantee and direct lending program aimed at communities served by Black-owned banks. This may take the form of a direct women and minority business lending program operated by the Commerce Department’s Minority Business Development Agency, or a loan guarantee program managed by MBDA and facilitated by large financial institutions with significant experience in insurance and loan guarantees, such as Prudential Insurance or Fannie Mae.

As banks continue to fail, there is an opportunity to positively reshape the sector, support marginalized communities and grow the U.S. economy.

Staff Writer; William M. Cunningham

One may also visit this brother online at: Impact Investing.

Leave a Reply