(ThyBlackMan.com) President Biden, included in his $2 Trillion SUPER SIZED Stimulus Package, paying off $10,000.00 per borrower of student loans. The Democrat House Leaders, not to be outdone, pushed for $50,000.00 loan forgiveness. Because our federal government runs a MONSTER deficit, this proposal adds $700 Billion debt (on top of the $23.3 TRILLION existing national debt) on our grandchildren, great-grandchildren, and BEYOND. I believe this proposal is unethical and irresponsible. Why should taxpayers who did not attend college or paid off their loans be FORCED, without a vote, to pay college loan debt?

COLLEGE DEBT FREIGHTRAIN ROOT CAUSES

What are the actual root causes of student loan debt? Colleges have been increasing tuition by seven to eight percent annually, while inflation is averaging less than two percent. Colleges are overcharging. While Congress loves to publicly grill CEOs in 100% WASTE OF TIME HEARINGS, they remain silent on a $1.7 Trillion {Total college loan debt} problem that is growing exponentially! If taxpayers pay off $700 Billion of student loan debt, college tuition is guaranteed to increase due to the GREED and incompetent management of most U.S. universities.

Another root cause, too many job counselors in high schools and colleges do a HORRIBLE job advising students on starting their careers. Students are going into six-figure debt for USELESS degrees. Colleges offer too many BELIEVE IT OR NOT degrees, and unfortunately, the numbers of SILLY majors are growing! Why are these Guidance Counselors still employed?

TRADE SCHOOL IS AN ALTERNATIVE TO COLLEGE – THE CHOICE IS YOURS

The outcome of education is to be prepared for what life throws at you and ALWAYS be financially secure. People have achieved financial freedom attending trade school, community college, or university. The individual’s work ethic and financial literacy make a significant difference in achieving financial freedom.

Some people look down on trade school graduates, that is until they NEED a plumber, electrician, carpenter, or someone with the skills and TALENTS they lack. Who are you going to call when your sump pump stops working and your $80,000 finished basement is being flooded? I’m guessing NOT Ghost-Busters!

MY SUMMER EDUCATION

One summer, Dad decided to put bricks around two circular flower beds in our backyard. It was my idea, and as a reward, Dad hired me out as free labor to the bricklayer. My title- Senior Fetch It Man! That experience was part of my education. I learned about the tools and the “how” from a master bricklayer. I even got to lay a few of the bricks. And yes, they are still standing! But my parents and I knew a trade was not for me. I do not enjoy working outside or with my hands.

COLLEGE VS A TRADE – ROSIE’S CHOICE

What if you had a daughter, Rosie, who worked beside you in your electrical business and loved it but also loves math and accounting. I know some of you are frowning, thinking a woman who loves electrical work, math, and accounting! It’s 2021, people. We have a woman as Vice President of the United States!

Given Rosie’s equal love of both fields, she logically decides to run the numbers. And her results surprise her so much she asked her Mom to check the math. Yes, Mom is better than Dad at math! Remember 2021!!

ROSIE’S ASSUMPTIONS

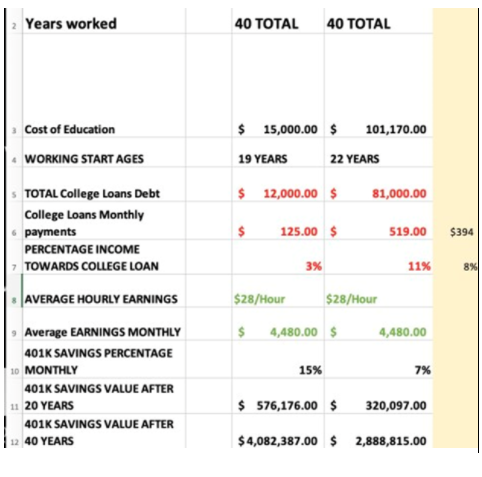

- Trade school cost ~$15,000.00.

- State University education costs ~$101,000.00.

- Will borrow 80% of education cost.

- Given the smaller amount of the Trade School loan, she will repay the Trade School loan in < 10 years and the University degree loan in about 20 years.

- She will start paid work as an Electrician at 19 years of age.

- Rosie will start her accountant career at 22 years of age.

- Both jobs’ starting pay is ~$28/hour.

- Assumes a three percent annual compensation increase.

- As an Electrician assumes a 15% contribution to her 401K (or other business retirement account).

- As an Accountant with ~$520.00/month student loan debt, Rosie assumes she can only afford a seven percent 401K contribution for the first 20 years.

- Both 401-K accounts assume a three percent company match and an eight percent annual return.

- Below calculations assume no promotions or entrepreneurial moves. This is unlikely over 40 years.

The above spreadsheet shows that Rosie is planning to retire after 40 years of work as an Electrician at the age of 59, with ~$4,082,387.00 in her 401K plan. Rosie is planning to retire at 62 as an accountant with ~$2,888,815.00 in her 401K plan.

As an Electrician, Rosie can retire three years earlier and have an additional ~$1,193,572.00 in her 401K account. The primary reason, today’s unreasonable cost of a four-year college.

CONCLUSION – THE CHOICE IS YOURS

We have a significant shortage of Skilled Labor Professionals in the U.S. Today, carpenters are in demand and being paid six figures in some locations. Millions of Americans discovered they could work anywhere when companies shut their offices down due to Covid-19. Companies and employees have finally realized many office employees do not need to spend one to two hours commuting to work each day. Consequently, millions of Americans have relocated to warmer locations. Or escape the high tax cities such as N.Y., LA, San Francisco, etc. With the bonus of lower real estate prices. New home construction has rapidly expanded in individual states and cities, including Florida, North Carolina, Texas, and more. “America is facing an unprecedented skilled labor shortage.” According to the Department of Labor.

The choice is yours, not your useless guidance counselor or the silly talking heads on television. Not the Congress members, most of which never held a real job. Find the career that brings you earnings to achieve financial freedom and hopefully some joy.

Some of my friends and family learned trades to achieve their financial freedom. In comparison, my brother and I used college to achieve our financial freedom. The choice was ours!

APPENDIX – The Highest Paying Trade School Programs 2020

- #7 – Dental Hygienists …

- #6 – Nuclear Medicine Technologists Degree. …

- #5 – Nuclear Technicians …

- #4 – Radiation Therapists Degree. …

- #3 – Power Plant Operators Degree. …

- #2 – Airline and Commercial Pilots Degree. …

- #1 – Air Traffic Controllers Degree.

#1 – Air Traffic Controllers Degree Median Annual Salary – $124,540

Projected Growth Rate: +1.0%

Education Required: Associate degree; trade school

YOU MAY ALSO LIKE BELOW PREVIOUS BLOGS

A BRICK-MASON’S JOURNEY TO BECOMING A MILLIONAIRE!

A BRICK-MASON’S JOURNEY TO BECOMING A MILLIONAIRE!

IT IS ALL ABOUT LEARNING; IT IS NOT ABOUT SCHOOL {GUEST AUTHOR – Deborah L. Grubbe, PE, CEng}

IT IS ALL ABOUT LEARNING; IT IS NOT ABOUT SCHOOL {GUEST AUTHOR – Deborah L. Grubbe, PE, CEng}

Education secretary says students should have additional educational and career pathways

Education secretary says students should have additional educational and career pathways

PURDUE GOING ON EIGHT YEARS WITHOUT A TUITION INCREASE- PROVING IT IS ACHIEVABLE

PURDUE GOING ON EIGHT YEARS WITHOUT A TUITION INCREASE- PROVING IT IS ACHIEVABLE

This Will Be The Biggest Disruption In Higher Education

This Will Be The Biggest Disruption In Higher Education

DO NOT DONATE YOUR HARD EARNED MONEY FROM YOUR RETIREMENT ACCOUNTS TO COLLEGES TO PAY FOR YOUR KIDS EDUCATION!

HOW COLLEGES FOOL YOU INTO OVERPAYING FOR UNDER PERFORMANCE

HOW COLLEGES FOOL YOU INTO OVERPAYING FOR UNDER PERFORMANCE

ABOUT ME

I am a proud nerd (as my beautiful wife and daughter have told me) investment and finance blogger with an N.C. State, Chemical Engineering, University Rutgers, MBA and Harvard University, Advanced Management education.

I left a corporate career because I desired to make a difference as a speaker and writer. I was blessed to be coached and mentored by strong women and men in my family and professional life. It is my time to serve and give back.

DISCLAIMER

I started my first business at ~13 years of age (a small but brilliantly created plant nursery). I am a successful investor in stocks, options, real estate, and happy to share my finance and investment lessons learned with you.

However, I am NOT a licensed financial advisor. Please do not construe my suggestions on this blog as recommendations for your situation. Please seek your licensed CPA or fiduciary financial advisors for individual financial advice.

I write this weekly blog to make an impact by reaching an audience and demonstrating the need for financial literacy. I will help you get there.

To follow my daily posts on Instagram, CLICK BELOW:

http://instagram.com/wealth_building_powers

Staff Writer; Styron Powers

One may visit this brother over at; Powers Investments Management and also connect via LinkedIn; S. Powers.

Leave a Reply