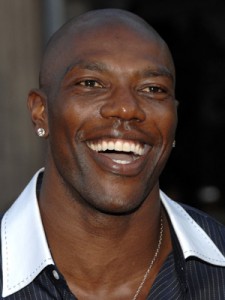

(ThyBlackMan.com) Terrell Owens has quite the financial burden on his shoulders at the moment. At the height of his career, he was earning millions of dollars and thriving in the NFL. To complement all of his success, he spent money like it was going out of style. Fast forward fifteen years later, T.O. is realizing that money doesn’t fall from the skies forever and that he isn’t the media and NFL darling anymore. He’s been dealing with an ACL injury that has rendered him unable to play. Coupled with the NFL lockout, T.O. has been overlooked by the NFL in the same way he has been overlooking his finances. With mounting debts like child support to mortgages, the future does not bode well at all. It’s the reality that many face on a daily basis. However, the football star does not seem to be taking the news well, crying on TV and alleg edly attempting suicide.

edly attempting suicide.

To be honest, there’s not much that can be done for Terrell Owens in his current financial state. He wants to continue his mega-millionaire lifestyle despite the fact that he has non-existent income and an unsubstantiated career. This is what we coin as the hardly-wealthy mindset. The biggest offence is when someone takes a paycheck and uses it to justify purchases that cannot even be covered with that one paycheck, telling themselves that future checks will cover the over-budget spending. However, with each paycheck, more gifts are added to the pile of spending, creating an endless cycle of liabilities. The only solution for T.O. is to massively liquidate some assets, adjust to his realistic financial reality, and drop the fantasy in his head that the good ole days of a glorious career will be returning.

5 Things We Can Take Away so that We Don’t T.O. Ourselves

1. Humility: We all, god-forbid, be an injury, illness, accident, natural disaster, competitor (company-wise, or co-worker wise), etc. away from consistent income. Nothing in this life is guaranteed. At some point, our careers end voluntarily or involuntarily. Which leads us to our next point…

2. Preparation/Foresight: Even billionaires aren’t guaranteed a lifetime of consistent income, as companies fall in and out of favor all the time. However, the wealthy elite do secure their post-retirement living with savings, trusts, and investments. The bigger your earnings, the more crucial it is for you to ensure that it will last the duration of your life, possibly including future generations. For every dollar you earn, you should be saving 10-30%. By saving, we don’t mean saving for that next Louis Vuitton shoe, we mean saving for your own personal wealth.

3. Mimic the Behaviors of Truly Wealthy: This one is always the most perplexing. People continue to follow in the footsteps of those that are blatantly broke and financially ruined due to their bad spending habits. T.O. was no exception. Instead of learning how to grow his wealth to Warren Buffet proportions, he spent it at the same reckless rate many financially-destructive athletes do.

4. Look Around You: There’s a belief that your income reflects the average of those closest around you. We find that to be true more often than not. Instead of asking NFL owners for financial advice, he partied it up with other hardly-wealthy people. If you keep the same people around you that were around when you had no money, you might eventually end up back to the same place you were before you had the money. While we’re not advocating dumping your lifelong friendships, we are advocating that you add positive influencers to your social circle. If your friends are becoming a financial burden, then we argue that those are not friends that you need in the long-run.

5. Stop Creating Needless Debt: Aside from a roof over your head, there are few other things that are must-haves. If you don’t have the money to pay for something upfront, you need to do a cash flow analysis on it. If you need a car to get to your job, then it is something that you might need to take on debt to purchase. However, it does not mean that you are entitled to a fancy, new car. Did you know that most Chinese families live most of their lives without using credit? They pay for everything, including their homes and children’s education, using cash. No available cash yields no purchases. We need to adopt this mindset if we are to become slave free to money. This may sound random, but men and women, if you are planning to hook up with someone and don’t want a child out of the situation, be responsible. T.O. has additional money woes because he has three children by three different women. Be responsible with your actions.

Our whole existence is to motivate individuals to attain and grow their wealth. Sometimes our suggestions do not go over well, as it contradicts the psychology of a hardly-wealthy person who spends way more than they earn. This pattern is seen over and over again in new money individuals, and they love branding naysayers to their spending habits as “haters”. Yet, once that bank balance reads at 0 or sub-zero, their non-haters and fans are nowhere to be seen to lend a hand. So, who is really hating? The answer will be found once they look in the mirror.

Staff Writer; India Love

For more encouragement regarding the wealth building and management of young minorities, visit; MinorityFortune.

Also connect with them via Twitter; http://twitter.com/minorityfortune.

If TO has any liquid assets he ought to liquidate enough to staunch the bleeding. Then he should use his network of pro players to get an idea as to how they manage their money. One thing I’ve learned from wealthy people is that they are always willing to share advice and information that made them successful. Here’s the rub. TO has to talk to an awful lot of these people because what worked for them, might not work for him.

@DG Thank you so much for reading our article. As long as you found it useful, then we’ve done our job.

@OriginalMan We’re glad to hear that you’re ahead of the curve in your financial literacy! Believe it or not, you are one of an elite few who do abide by these mantras. Unfortunately, the people who need this advice the most overlook it. This information is in dire need of their attention! Perhaps we could partner up with Gucci, Rolls Royce, Jimmy Choos, Nike, Rolex, etc. to see if we can print financial literacy tips on their products? Thanks for reading!

This is a phenomenal, and very practical article. Great job Indie!

Loved the article….i can honestly say that i follow the guidelines that you

listed above concerning how to manage your money to prevent going broke. Im sure T.O. would have benefited from this wise advise had he had the knowledge

and people around him to help him keep his money. Well you live and learn.