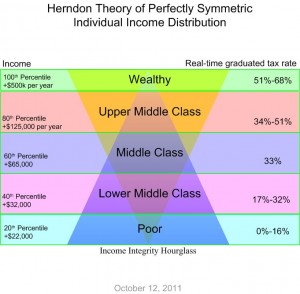

(ThyBlackMan.com) I believe in the power of capitalism to harness the human instinct of greed. I believe that profit is a great motive for business transactions and facilitates economic activity and efficiencies. I also believe in fairness. The Herndon Theory of Perfectly Symmetric Individual Income states that the flow of capital has to be facilitated by taxation upon all levels of income earners whom are not suffering in poverty. It proposes to do so by utilizing an hourglass shaped structure which represents an intersection of personal income and personal taxation level (Figure 1). The center of the structure represents the largest area of intersection between income and taxation levels. The center represents the middle class and in the spirit of absolute fairness, I propose that the middle-class in America pay 33% of the federal tax load where incomes are between $65,000 and $125,000 per year.

This group of Americans would be the only group exempt from graduated tax levels in order to provide a strong taxation core which is not as subject to economic extremes as are the wealthy and the poor. The working poor whom earn above the poverty line should be taxed progressively on a real-dollar earned basis up to a maximum of 16%. This limit represents one-half of the 33% of all federal tax liability apportioned to the poor and lower-middle class who shall pay a real-dollar graduated tax rate between 17% and 32%. The upper-middle class and wealthy will be taxed on a progressive real-dollar basis between 34% and 51% while the wealthy are taxed between 51% and 68% I  propose applying the Herndon Theory of Perfectly Symmetric Individual Income Distribution as a restructure to the United States Federal Tax Code. It must be applied uniformly to be successful without any exemptions.

propose applying the Herndon Theory of Perfectly Symmetric Individual Income Distribution as a restructure to the United States Federal Tax Code. It must be applied uniformly to be successful without any exemptions.

The model utilizes Brad Delong’s Log Income Levels by Percentile as the basis for determination of taxation strata by income distribution. Delong’s research and graph (Figure 2.) has been cited by both Catherine Rampell and Paul Krugman as statistically significant and applicable. For the purpose of this presentation, I have utilized 2010 income distribution statistics as demonstrated

It is my personal belief that the quality of life for the middle-class of any nation is the bellwether in regards to income distribution and economic fairness in a competitive economy. A market-based competitive economy must revolve around the central feature of consumerism. Consumer behavior is well understood and it has become codified knowledge in terms of who spends what percentage of their income on goods and services, which is the very activity that fuels our economic engine. The nation’s middle class and those wage-earners who earn less are likely to spend 100% of their income as opposed the more prevalent savings and investment behavior among higher earners. A nation’s economic engine only performs in a robust manner when it is sufficiently provided with robust demand from consumers. America’s current business problem is low demand due to lack of disposable consumer income which should naturally be strongest between the 60th and 80th percentile of wage earners. These demographic accounts for 33% of the wages earned and should pay 33% of the taxes.

In order to come to market certainty and macroeconomic strength, I propose that the United States reform its taxation policy into a simple stratified personal income tax at all government strata, but particularly at the federal level as illustrated in Figure 1. I propose this system in the spirit of patriotic duty, shared sacrifice, and fairness. In terms of taxation policy, America has to begin treating its middle-class as just so; in the middle. The nation should also tax low wage earners on a real per dollar earned graduated scale. I believe that it is fair to ask all working Americans above the poverty line to pay taxes. I also believe that those earners below the poverty line should be 100% tax exempt at all government strata. I propose that the upper-middle class and wealth be taxed for 33% of all federal taxes and that the lower-middle also pay 33% of all federal taxes with all tax payers paying real-dollar graduated tax rates to ensure fairness and the integrity of the Income Integrity Hourglass (Figure 1). Real-dollar tax rates progress between the income strata minimum and maximums on a per dollar earned graduated basis depending on the income distribution within each strata.

The design of the Income Integrity Hourglass is easy and simple enough to explain to a child. It provides a simple framework that ensures the flow of capital from the top to the bottom and vice-versa. It insures that that the tax portal applied to the middle-class is sufficient enough to facilitate balanced consumer activity no matter which way the sands of the metaphorical hourglass should shift. The hourglass then becomes the macroeconomic eco-chamber for all personal income in America bar none.

The intent of this design is to simplify the U.S. tax code and can be applied to any government strata. In a vacuum, all other federal tax code would be eliminated and the federal income tax would be applied to all income transactions to include estate income. I propose that a separate tax code using the same model be constructed in parallel designed around business revenue and capital gains in lieu of personal income in American businesses. If applied, this should level the playing field in American business, small American business would be allowed to thrive and large American business would pay a proportionate share of the federal tax liability. This structure will provide statistically significant certainty to the American enterprise and investment markets.

DeLong, Brad (2010). Log Income Levels by Percentile (graph). Retrieved from http://delong.typepad.com/sdj/2011/01/on-the-richness-of-the-rich-once-again.html

Krugman, Paul (Jan 2011). Why does Inequality Make the Rich Feel Poorer? Retrieved from http://krugman.blogs.nytimes.com/2011/01/12/why-does-inequality-make-the-rich-feel-poorer/

Rampbell, Catherine (Jan 2011). Why So many Rich People Don’t Feel Very Rich. Retrieved from http://economix.blogs.nytimes.com/2011/01/11/why-so-many-rich-people-dont-feel-very-rich/?partner=rss&emc=rss

Staff Writer; Darrick Herndon

For more thought provoking articles by this writer visit; blackfrankluntz.

Dycegame thanks! I couldn’t remember the name of the theory behind it –

Laffer curve – http://en.wikipedia.org/wiki/Laffer_curve

No Darrick, it isn’t about sides. I stated before I believe the rich should pay more, I simply don’t believe that it is fundamentally fair for anyone to pay more taxes than what they make. To me that is a form of governmental coercive extortion. Fair is not an objective term bro, it is subjective.

Secondly, simply saying that it isn’t “fair” doesn’t address the issues of productivity when you have a progressive tax system where return on labor is outpaced by increases in taxes.

Even if we move beyond your top group to the second, you are still talking about paying close to half of everything you make in taxes. The same argument applies.

A progressive tax system is cool but it has to be done with consideration not just for the revenue that it produces for the government (taxation) but also with understanding that taxation is a result of productivity. IE the less a person generates the less you can tax them, therefore if you study anything about tax theory you know that as the tax rates increase you begin to get a marginal return to the point of a negative return because people reduce productivity.

You can’t assume that indiv

You gentlemen just protected the richest one-half percent of Americans. Stated plainly, 1/2 of 1 percent of Americans earn more than $500,000 per year and you would protect them. I suppose we know whose side you’re on. I am about what’s fair. This plan is wholly fair.

Hi

We ALL see the pyramid scheme symbol on the back of the USA one dollar bill. We ALL see the servitude infestation in capitalism. We ALL see the “pay up or lose your wellbeing” Chicago mob-like felony extortion widespread within capitalism. We ALL see the “join or starve” felony extortion done to the 18 year olds… by this ugly competer’s church called capitalism. We ALL see how forcing competer’s religions onto 18 year olds, and/or LURING them into it with bling-dangling and promises of empowerments… kills membership in the cooperator’s church (Christianity/socialism). We ALL understand that AmWay (American Way) (New World Order) got “the exclusive” (legal tender) on the TYPE of survival coupons (money) accepted in supply depots (stores) and leverages 18 year olds into the organization via that felony activity. (It puts AmWay-coupon slaving requirements called price tags… on all the survival goods). We ALL understand how sure-to-collapse farmyard pyramids work… from our childhoods. Upper 1/3 are “heads in the clouds” while the kids on the bottom ALWAYS GET HURT from the weight of the world’s knees in their backs. And, we ALL see how such systems are illegal, immoral, and just plain sick.

We American Christian socialists are patiently awaiting the natural fall of the pyramid-o-servitude, or the busting of the free marketeers felony… by the USA Dept of Justice. We Christians are VERY CLOSE to issuing a cease and desist order until the servitude and inequality goes away… which means it turns into a commune. Commune is a word we LOVE when used in the word “community”… but its one the caps HATE when used in the word “commune-ism”. Go fig. PROGRAMMED!!

Do a Google IMAGE SEARCH for ‘pyramid of capitalist’ to see a full color picture made way back in 1911, when capitalism was first discovered to be a con/sham instigated by the Free Masons/Illuminati. Folks sure bought into the thing… hook, line, and sinker just the same. The caps didn’t even check if a string was attached! Now THAT’S easy fishing, eh?

Time to level the felony pyramid scheme called capitalism. Abolish economies and ownershipism worldwide, and hurry. Economies just cause rat-racing, and rat-racing causes felony pyramiding. BUST IT, America! Look to the USA military supply/survival system… (and the USA public library system) for socialism and morals done right. Equal, owner-less, money-less, bill-less, timecard-less, and concerned with growth of value-criteria OTHER THAN money-value. Quit doing monetary discrimination immediately, and make it illegal. There are MANY measurement criteria of “value”… not just dollars. Try morals, efficiency, discrimination-levels, repairability, etc etc. Economies are cancerous tumors, and to cheer for their growth… is just insane. Profiting causes inflation, so if caps LIKE inflation, and if they LIKE a terrible time in afterlife when they meet the planet’s ORIGINAL OWNER before caps tried to squat it all with ownershipism, then keep it up with the felony pyramiding. I dare you. While us Christians are finally bulldozing that pyramid scheme back to level, lets make servitude and “join or starve” (get a job or die) illegal in the USA, and lets level the architecture seen in USA courtrooms, too. Right now, USA courtrooms are church simulators or “fear chambers”, by special design. Sick.

Isn’t that back-of-the-dollar pyramid… a Columbian freemason symbol? And WHERE is the USA gov located? District of Columbia? (Not even part of the USA!) How much more blatant can ya get? The “Fed” runs a pyramid scheme called the free marketeers. If you’re using the “federal reserve note” certificates, or using no-other-living-thing-on-the-planet entitles of ownership, you’re bought into a servitude/slavery con/sham… called capitalism. Pyramiding 101.

Larry “Wingnut” Wendlandt

MaStars – Mothers Against Stuff That Ain’t Right

(anti-capitalism-ists)

Bessemer MI USA

@DG you just described the Laffer Curve

I wanted to add this too.

Also at a certain point you do create a disincentive to generate more wealth if you recognize that incrementally you profit will be consumed by taxes at a certain point. For example, under your model –

At $500K you are at 50% (rounded for simplicity). That represents $250K of take home. Let’s say under your model you create $350K at 40% that is $210K take home. A rational actor is going to weigh the cost to generate $150K in revenue, versus the value of acquiring $40K of additional income.

My point is that at a certain point individuals are going to say reduce productivity, because the incremental growth in revenue versus taxes won’t be sufficient enough to justify their increase labor.

Derrick that is interesting but I have one philosophical more than technical problem with this approach. I do not believe that ANY EVER should have more than 50% of their income taxed. At that point you work more for the government than you do for yourself, and that is a dangerous position when you are in a democratic republic with a free market based economy.

I am for a progressive tax system but if you tell me that 70% of all income that I create (rounded up at the top of the bracket) is going to the government I am going to revolt, look for loopholes, move my business out of the country, or do other things.