(ThyBlackMan.com) What does it mean to retire? Believe it or not, there is no official definition. Sure, you can look the word up in a dictionary. But that will tell you almost nothing about what it means to retire. A popular definition is:

To leave one’s job and cease to work, typically upon reaching the normal age for leaving employment.

With a definition like that, it is hard to distinguish retirement from death. You should have a better reason than reaching a certain age to stop doing the thing that, for most of your life, defined what it means to live. If you are letting someone else tell you when to retire and what that means, then by definition, you are not retiring on your terms. Here are a few suggestions that can help change your  retirement outlook:

retirement outlook:

Paying for Retirement

No matter how you define retirement, it is very likely going to require having more money than you are able to actively produce at the time. That means you will have to find a way to put a substantial amount of money away against the day when you need it for retirement. There are countless ways to do this, including savings, 401ks, and other types of investments. But if you own a house, it is possible that you already invested the money necessary for retirement.

A reverse mortgage is exactly what it sounds like. Instead of you making a house payment every month, the mortgage company makes an equity payment to you. That really is the essence of a reverse mortgage. Reversemortgages.com explains it this way:

A reverse mortgage is a loan available for seniors age 62 years or older that converts your home’s equity into cash. Instead of worrying about mortgages payments every month, the homeowner receives payments from a lender. The borrower is then only responsible for staying up to date on real estate taxes, homeowner’s insurance, and maintenance.

Every situation is different. And a financing plan that is right for one person may be disastrous for another. So be sure to do your research and get advice from someone in the know. But if you have a definition of retirement that includes spending a lot of money that you are no longer making, the equity you have put into your home may have already paid for it.

Do Nothing

People who perform extreme physical labor for a living might find themselves fantasizing about a more sedentary lifestyle. A break from responsibility can be just as appealing as a break from hard labor. But what a lot of early retirees do not realize is that doing nothing is a lot more work than it seems. Even vacations can be too long. Having nothing to do for the rest of your life will start to feel more like prison than retirement.

Doing nothing really means a life without responsibility and stress. You will want to own your own home or have rent payments well within your monthly fixed income. You might help out babysitting the grandkids, but have no interest in raising them. You might join a social club without any desire to take a leadership role. A do-nothing retirement without responsibility has to be carefully planned so that you can live within your means, yet be filled with activity. It is less a long vacation, and more a passing of the responsibility torch.

Second Act

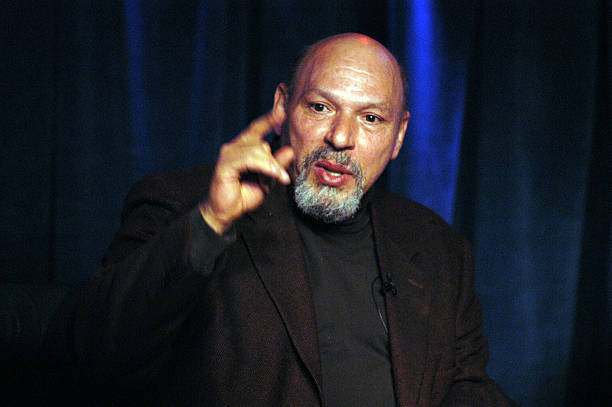

Entrepreneurs and CEOs don’t retire. They move on to whatever’s next. Jon Rubinstein didn’t come out of retirement to create WebOS because he needed the money. He did it because he needed the challenge. At some point, it may become necessary to do something other than that which you did for a living all your life. But for many, that is just an opening to explore their second act.

Retirement is what you make of it. If you want to define it and control it every step of the way, make sure you have the money to pull it off. Plan to stay active, even if that activity is devoid of responsibility. And if that life doesn’t appeal to you, start working on your second act right now. For many retirees, the best days are yet to come.

Staff Writer; Paul James

Leave a Reply