(ThyBlackMan.com) Management of finances within your business is an important aspect that requires the utmost efficiency to speed up the growth of the business. Opening a Current Account tailored to your needs can go a long way towards enhancing your financial transactions. One such option is the Zero-Balance Current Account, which is versatile and useful since a client is not required to maintain a minimum balance.

What is a Zero-Balance Current Account?

In business terms, the allowable balance maintained by the customer is zero under a Zero-Balance Current Account opening structure. An essential condition required for any current account is that this Zero-Balance Account enables the owner to maintain a ‘Zero’ balance without penalty or charges.

3 Special Features of a Zero-Balance Current Account

- No minimum balance required:

An outstanding feature of a Zero-Balance Current Account is the absence of a minimum balance restriction. In simpler terms, this allows customers to operate the current account without depositing money into it.

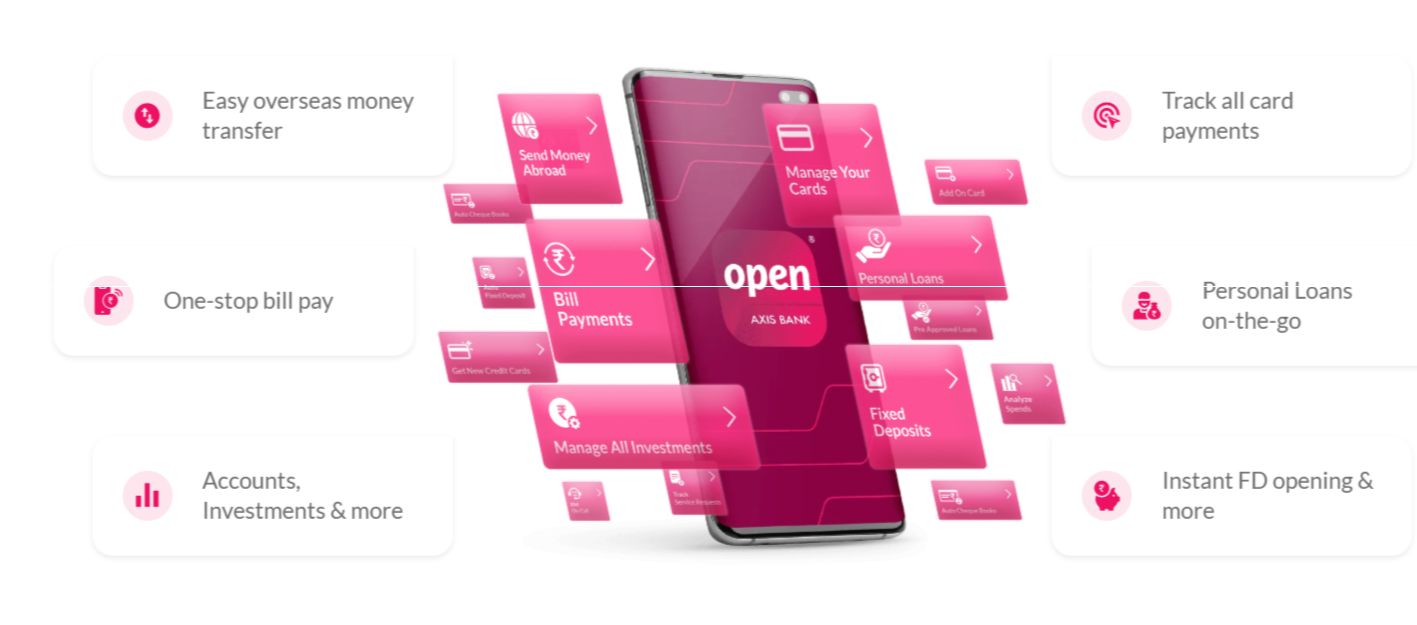

- Online banking:

Zero-balance current Accounts come with online banking facilities, so you can manage your account from the comfort of your home, make and receive payments, and view your account statements on demand.

- Overdraft facility:

Some banks offer an overdraft facility with a Zero-Balance Current Account, and this is a very good option as sometimes a business may need short-term credit. It can be useful for covering cash flow shortfalls or unforeseen expenses.

Top reasons to open a Zero-Balance Current Account

Improving cash flow management:

With a Zero-Balance Current Account, you won’t ever be hindered from maintaining a minimum balance while managing your cash flow. This makes the account ideal for individuals and companies with varying revenue cycles or seasonal fluctuations.

Make vendors and other payments in due time:

Using a Zero-Balance Current Account, you will be able to service your debts promptly to vendors and suppliers, efficiently manage business transactions, and maintain a good rapport with the partners.

Ability to access loan facilities:

Overdrafts and other credit options, which are usually available with some Zero-Balance Current Accounts, can be handy during periods of cash flow problems or when barriers to business growth are desired.

No additional fees for maintaining minimum balance:

Unlike the usual tradition of Current Accounts, the customer holding a Zero Balance Account will not be charged any penalty fees for keeping a low balance. This can save a lot of money regarding fees and bank charges.

Things to be taken into consideration when opening a Zero-Balance Current Account

Business needs:

Review your business requirements and the number of transactions to see if a Zero-Balance Current vouched account fits your expectations. Other types of Current Accounts may be more suitable if the volume of transactions is relatively high or other elevated banking provisions are needed.

Bank-related charges:

Since Zero-Balance Current Accounts do not depreciate due to low operational balances, other accounts may compensate for dormant operational balances. Still, they may possess transaction and other service fee charges. Look through the bank’s charge schedule to ensure you are aware of all the costs you will incur.

Current Account’s additional features:

Another factor to consider is the other capabilities that the financial institution provides, including, but not limited to, internet banking, mobile applications, a chequebook facility, and debit cards. Such features would enable effective and efficient business financial management.

Conclusion

For businesses substituting for cost-intensive and rigid banking structures, opening a current account with no balance closing requirements is essential. Viewing the features and advantages that accompany a Zero-Balance Current account helps businesses decide whether a particular account is in line with the business’s operational needs. Factors such as the number of transactions, bank fees, and other account features should also be considered before opening a Current Account. With these recommended account conditions, a business can expand, and shift focus to measurable output.

Staff Writer; Greg Jacobs

Leave a Reply