(ThyBlackMan.com) When anyone criticizes Biden’s Build Back Better blueprint, Biden’s retort usually is, 15 Economic Nobel Laureates have approved his plan. It is, as if he is saying, because these 15 notable people have spoken over this blueprint, are we now, limited to just blindly accepting this as a plan that needs no adjustments, only our support?

Notice, I said the blueprint, and not the overall Build Back Better agenda. The agenda can be viewed as the final product and the blueprint as the wiring necessary to see this final product come to fruition. Can Mr. Biden be successful in making this economy work for all of us, which he says is his goal? I contend he won’t, as there is a serious flaw in the wiring of his plan. Unless it is fixed, the nation will economically suffer.

Here is the thing, if you see some serious problems in the wiring that will cause the Build Back Better agenda to be derailed, you would think, once alerted, Mr. Biden and the Democratic Party, especially the Congressional Black Caucus (CBC), would want to make some adjustments; the CBC, because Black Americans have an enormous stake in seeing Biden’s agenda succeed, as we have the highest unemployment rate of any worker group, and the lowest percentage of business ownership. However, them wanting to take a look, has not been the case. As initially said, rather than, wanting to examine the problem and make the adjustment, Biden, his team, and I am assuming the CBC too, are hiding behind the Nobel Laureates’ iteration.

It’s deeply disturbing and unsettling to see the Biden administration not correct this issue, when it is a real big deal. It’s as if he and Democratic Party leaders would rather hand the Congress to the GOP in 2022, rather than do the heavy lifting, to set our economy on the right track. So, is this the modus operandi of the Democratic Party; ignore the problem and its messenger, hoping both will go away? It’s a strategy for losers. Nevertheless, there is no exaggeration of the import of this “wiring problem.” Let’s really take a good look at the issue under discussion and see if you agree.

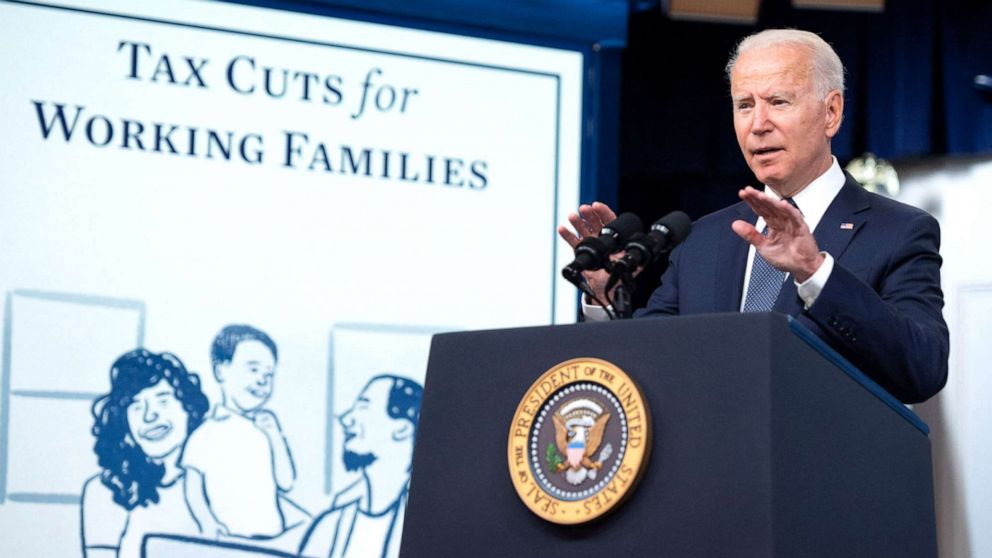

Biden, Pelosi, Schumer, and the Democratic Party are “shooting themselves in the foot,” and taking American workers down with them, by creating an unsure economic future. Slow economic growth reminiscent of the economy, after the 2008 Great Recession, will ensue if the issue is not fixed. Remember, it is not the agenda, it’s the wiring that needs to be addressed. FACTORS surrounding the Biden Tax Cut (not a tax break) can affect its success. Again, to make this economy work for all of us, which Biden says is his goal, then he must give attention to a FIX when it comes to an underlying problem.

Here are the facts in regard to the current Consumer Tax Cut to Families with Children and its cost. Using Democrats’ figures, roughly $15 billion monthly in TAX CUTS started going out with 170 days left in this year, as the Tax Cut to Families programs got underway in July and is scheduled to end on December 31st. It resulted in $529 million a day being given to and spent by consumers, every day, on average.

Consumer spending, as a result of our first acknowledged Consumer Tax Cut is working efficiently, when it comes to creating jobs. It is no longer a theory. Consumer spending contributed to the creation of 1.091 million jobs in July, 366,000 in August, in spite of the onset of the Delta variant, and created 194,000 jobs in September, as many experts attested to the cresting of the effects of the variant, as fewer workers were sidelined in mid-September, as cases peaked.

Consumer spending is working as it should. September’s job numbers are important, as it confirms Democrats’ Tax Cut to Families with Children which is the nation’s first admitted Consumer Tax Cut, is consistent in growing jobs, even in the midst of Delta. It’s obvious to anyone who is paying attention, regardless of their profession or background, Democrats have the winning strategy right in the palms of their hands, going forward when it comes to growing our economy and jobs. It is called a CONSUMER TAX CUT, which has led to Consumer Spending!

It is being affirmed, that which Consumption Data shows. Consumption data shows, low-and middle-income Americans are more likely than wealthy earners to spend benefits, from the government immediately, and stimulate economic growth, creating millions of jobs. So, we can factually say, because we have DATA right in front of us, and are actually living it, the principle of giving consumers a Tax Cut, actually works, when it comes to growing our economy and jobs.

Knowing that Consumer Spending, as a result of a Direct Consumer Tax Cut is working in creating jobs, and economic growth, we want to make it more efficient. “Therein lies our wiring problem.” The Tax Cut to Families with Children has gotten us here, but it is just not suitable or capable of taking our economy further when it comes to achieving long-term job creation, which is what our nation needs, and here is why.

Simulate or STRESS-TEST the impact of high interest rates on the beneficiaries of the Consumer Tax Cut to Families with Children, and you will find those who are a part of any worker group are negatively affected by higher interest rates. This is true of all worker groups. Although, some are more severely affected than others, as rates rise.

Interest rates are a blunt tool. When the Federal Reserve uses rate increases to control inflation, it affects the entire economy. The beneficiaries of the Tax Cut to Families with Children are prone to be laid-off like all other workers. Layoffs will reduce the effectiveness of the Tax Cut to Families with Children when it comes to job creation, due to a loss of income to the recipients, as a result of them being laid-off from their jobs, leading to a reduction, in consumer spending, which reduces economic growth, and the ushering in of a slow growth economy.

The Federal Reserve recently announced, it will consider rolling back its easy money policies, as we approach the end of the year, to fight inflation, which should be of concern to Mr. Biden, his team, and Democrats. Such a move by the Federal Reserve could set-up interest rate increases sometime in 2022, and beyond. As a result, it is incumbent on Democrats to shift the Consumer Tax Cut to a much more resilient demographic, starting in January of 2022, that will endure higher interest rates, in order to keep our economic expansion on track, when it comes to sustaining job creation, which is the bedrock of our, or any growing economy.

If Biden and Democrats consistently grow GDP and JOBS, the probability that they will win in the Congressional elections in 2022 is remarkably high. Shifting the Consumer Tax Cut to a stronger and more resilient demographic does not mean the abandonment of the Tax Cut to Families with Children. On the contrary, it means that program will likely be sustained over the long-term because Democrats will keep control of Congress.

If extrapolated, out over ten years, we are looking at a cost of $1.8 trillion for the cost of the Tax Cut to Families with Children. So, reduce the amount of the money being spent on Families with Children Plan and shift the difference to a data-based demographic, which will complement the Federal Reserve’s efforts to control inflation, and also withstand rate increases.

Baby Boomers, as a homogeneous group, who are retiring at a rate of 10,000 a day, is statistically the best target of the consumer tax cut. When it comes to daily interest rates increases, Baby Boomers are not affected, because they are for the most part retired. Thus, they are able to continuously spend benefits from the federal government, consistently sustaining job creation, and growing the economy, as the Federal Reserve incrementally raises rates to control inflation.

Additionally, DATA shows, they are responsible for close to 40% of all consumer spending. That means they will spend the benefits from the federal government, sustaining Job creation. Baby Boomers also, include a fair number of minorities and rural whites. A 10%, $25,000 Consumer Tax Cut, will drop $254 to $300 million, a day into our economy, for businesses, both large and small to compete for, over the next 10 years, which is the duration of the tax cut. This $1.5 trillion Consumer Tax Cut Plan, (https://thefixthistime.com/the-10-25000-consumer-tax-cut-explained) as a result of consumer spending, will continue to consistently create jobs at a hefty rate and expand our economy.

Staff Writer; James Davis

Mr. Davis is a leading expert and consultant in Financial Analysis and Social Dynamics. He is a graduate of Florida A. and M. University (FAMU), a former stockbroker, and a human rights activist who resides in Sanford, Florida. He was awarded the prestigious Governor Haydon Burns Scholarship to attend FAMU and while at FAMU was awarded the first Martin Luther King Scholarship. He is the author of three books, among them is “The Fix This Time,” Boost Your Retirement Income! Simultaneously Create Jobs and Spur Economic Growth (https://www.amazon.com/dp/B00MI3PD2M).

Mr. Davis can be reached through his blog @ https://thefixthistime.com.

Leave a Reply