(ThyBlackMan.com) When you think about student loan debt, do you really think about the implications it has on each race? If you did not, this article will help you realize that some students experience more financial hardship than others and some students are more prone to taking out loans than the next.

- More Students Have Debt

Believe it or not, roughly one out of every five students owes student loan debt. This number is shocking and means that out of 200,000 students, 40,000 of them owe money for their student loans.

In fact, the amount of student loans doubled by 2013 from 3.4 percent to a high of 6.8 percent. Many African American students make up this number and more African American students take out student loans than other races. In 2013, 42 percent of African American families had student loans, compared to 28 percent of white families.

- African Americans Have Higher Debt

In fact, 27 percent of African Americans with a bachelor’s degree in the 2007 to 2008 school year owed roughly $30,000 in student loan debt, whereas, only 16 percent of whites owed the same amount.

The high debt level owed by African Americans continues to grow as students remain in school and graduate with higher degrees.

- High Average Debt

As mentioned above, African Americans have a higher amount of debt once they graduate with a bachelor’s degree and the average amount across the board is $30,000. This amount is much higher than other races who have a lower amount including whites at $18,000 and Hispanics at $22,400.

As the cost of schooling continues to rises, these numbers will  continue to grow as well, meaning that African American students will have the highest amount of debt consistently.

continue to grow as well, meaning that African American students will have the highest amount of debt consistently.

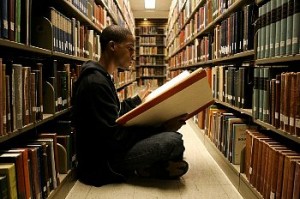

- More African Americans Are Going to College

Previously, it may not have been as common for African American men and women to go to college, but as of 2010, the enrollment rate has increased drastically. In fact, there has been a 15 percent increase across the board for African American enrollment in colleges.

In addition, more African American women are pursuing a college degree than men. About 21 million black students were enrolled in a college degree seeking program as of 2010.

- Income Bracket Doesn’t Matter

When it comes to student loan debt, income brackets do not matter as African Americans still hold the most debt. Black college students who were pursuing a four-year degree at a public university with parents who had an income of less than $30,000 had roughly 16 percent of the debt while white students with the same factors held only 8 percent of the debt. That being said, upon graduation high levels of income might help African Americans looking to refinance student debt. Income plays an important role in determining who qualifies for refinancing.

- Younger Age Equals Higher Debt

While you may not think that someone younger could have a higher debt amount than someone older than them, statistics show otherwise. In fact, 40 percent of African American homes that were headed by someone who was under the age of 35 held the most debt than any other race within the same age group.

- Shared Debt is on the Rise

When you are married, shared debt is debt that is combined between you and your partner. Although you are not responsible for each other’s federal or private student loan debt, it is still factored together when looking at your income as a couple.

As of 2010, 10 percent of African American households had a combined student loan debt of roughly $61,000. This is a high number for debt and many students feel as though they are beginning to drown when they see the large numbers.

African American students have a lower completion rate of college as well, which means that many of them will still owe a large chunk of money even if they do not finish college. Student debt is a huge burden for many students and if you are unable to step into your chosen career and make a nice livable wage, you may find yourself struggling to live in an apartment, pay your student loans, and eat each month.

To help cut back on the price of your student loan monthly payment, consider exploring other payment options such as an income-based repayment plan and only borrow enough money to cover your tuition and books.

Staff Writer; Roy White

Leave a Reply