(ThyBlackMan.com) Progress of a whole generation is just gone…

The Great Recession has been hard on almost everyone, but it’s been really tough on black households, who have seen much of the economic progress of the past generation disappear…

Despite high-profile success stories such as Barack Obama or Oprah Winfrey, the typical black family is poorer by some standards today than it was nearly 30 years ago. In a country where access to capital is everything, most blacks have nothing.

Part of the story of the recession is a story about jobs. The unemployment rate for most demographic groups essentially doubled during the recession, according to the Bureau of Labor Statistics. For blacks, the jobless rate rose from 7.7% to 16.5%, while the jobless rate for whites went from 3.9% to 9%.

Those disparities in employment are well known. What’s not fully appreciated is how deeply the recession cut into the incomes of black households, and how the recession devastated the wealth of black families.

Median household income for blacks fell 7.2% from 2007 to 2009, significantly more than the 4.2% decline for whites or the 4.9% drop in Hispanics’ income, according to the Census Bureau. (The median means half of households had more, half had less.) See the data on median income at the Census Bureau’s website.

It’s not until you look at the figures for net worth — assets minus liabilities — that you can understand just how marginalized blacks are in our capitalist society.

$2,200

Most blacks really don’t have any capital at all. The average black person leaves his or her heirs just enough to pay the undertaker, with the typical black household’s net worth totaling just $2,200, according to the latest data.

Let’s be clear: The vast majority of wealth in this country is owned by a few people, mostly white. It’s estimated that about 80% of all wealth is owned by  20% of the people, while about a third is owned by the top 1%. About 40% have no wealth at all.

20% of the people, while about a third is owned by the top 1%. About 40% have no wealth at all.

What little wealth the typical black family has is mostly tied up in the house. With housing prices falling for the past five years, black wealth has been wiped out.

The typical black family had about three times as much wealth in 1983 than it did in 2009 — $6,300 in inflation-adjusted terms in 1983 compared with just $2,200 in 2009, according to an analysis of the Federal Reserve’s Survey of Consumer Finances. Read more about the survey on the Fed’s website.

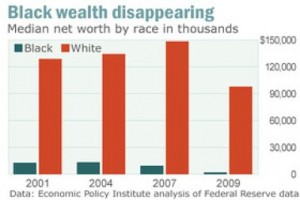

The figures are shocking. In 2001, the median net worth of a white family stood at $124,600. For blacks, the median wealth was $12,500. For every dollar of wealth owned by the typical white family, the typical black family had 10 cents. Remember, these are figures for middle-class families.

By 2007, the median wealth for white families hit $143,600, thanks to the housing bubble and a stock-market rally. But blacks were left behind. They don’t own many financial assets, and they missed out on the housing bubble almost completely. Their net worth fell to $9,300. For every dollar of capital owned by middle-class whites, middle-class blacks had 6 cents.

Then things got even uglier. By 2009, the typical white family had $94,600 in wealth, compared with $2,200 for blacks, according to an analysis by economist Edward Wolff. Blacks had 2 cents on the dollar.

Hold on a minute. How can it be that blacks missed out on the housing bubble? According to conventional conservative wisdom, the housing bubble was inflated specifically to help blacks buy homes through government policies, such as the Community Reinvestment Act that forced banks to lend to blacks and other poor and undeserving folks.

Yet the facts don’t support that theory. The home-ownership rate for blacks actually declined during the housing bubble after rising in the late 1990s. After peaking near 50% in 2004, the ownership rate for blacks fell to 47% by the time the bubble burst in 2006. See home-ownership rates on the Census Bureau’s website.

Black home owners were targeted by predatory lenders in the private sector, though. When it came time to refinance their mortgages to take advantage of lower rates and the opportunity to cash out, blacks with good credit scores were much more likely to be steered into high-cost, high-risk subprime loans than whites with the same credit scores. Once black home owners fell behind, they were nearly twice as likely to be foreclosed on as similarly situated whites. Read more about predatory lending at the Center for Responsible Lending.

Wealth is like sourdough

Around the globe, accumulating capital has been seen as the key to economic development. The nations that have grown the fastest have been those with the most equal distribution of wealth. Asia is growing much faster than Latin America, for example.

But wealth is a bit like sourdough bread — you need a starter to get it going.

Each generation of black youth starts out with a deficit, not a legacy. Parents or grandparents don’t have the capital to pass along to the kids to pay for school, buy a home or start a business. Black college graduates carry a heavier student-loan burden than white graduates. White kids backed up by their parents can better afford to work at the unpaid internships that increasingly are crucial to enter certain professions.

Most black families are caught in a trap, and it’s not any better for millions of working-class families of other races. In a world where wealth begets wealth, upward mobility is a struggle. Poverty is just one layoff or illness away.

Americans like to believe that anyone can make it with hard work. If you are exceptional, hard work and a little luck might be enough. But if you have average talents, like most of us, there’s nothing like a little capital to get you on your way.

Unfortunately for many working-class blacks, whites, Hispanics and Asians, the Great Recession washed much of the wealth they’d managed to gain. It’ll be very hard to build it back up without a steady and good-paying job

Written By Rex Nutting

Official website; http://www.marketwatch.com

Leave a Reply