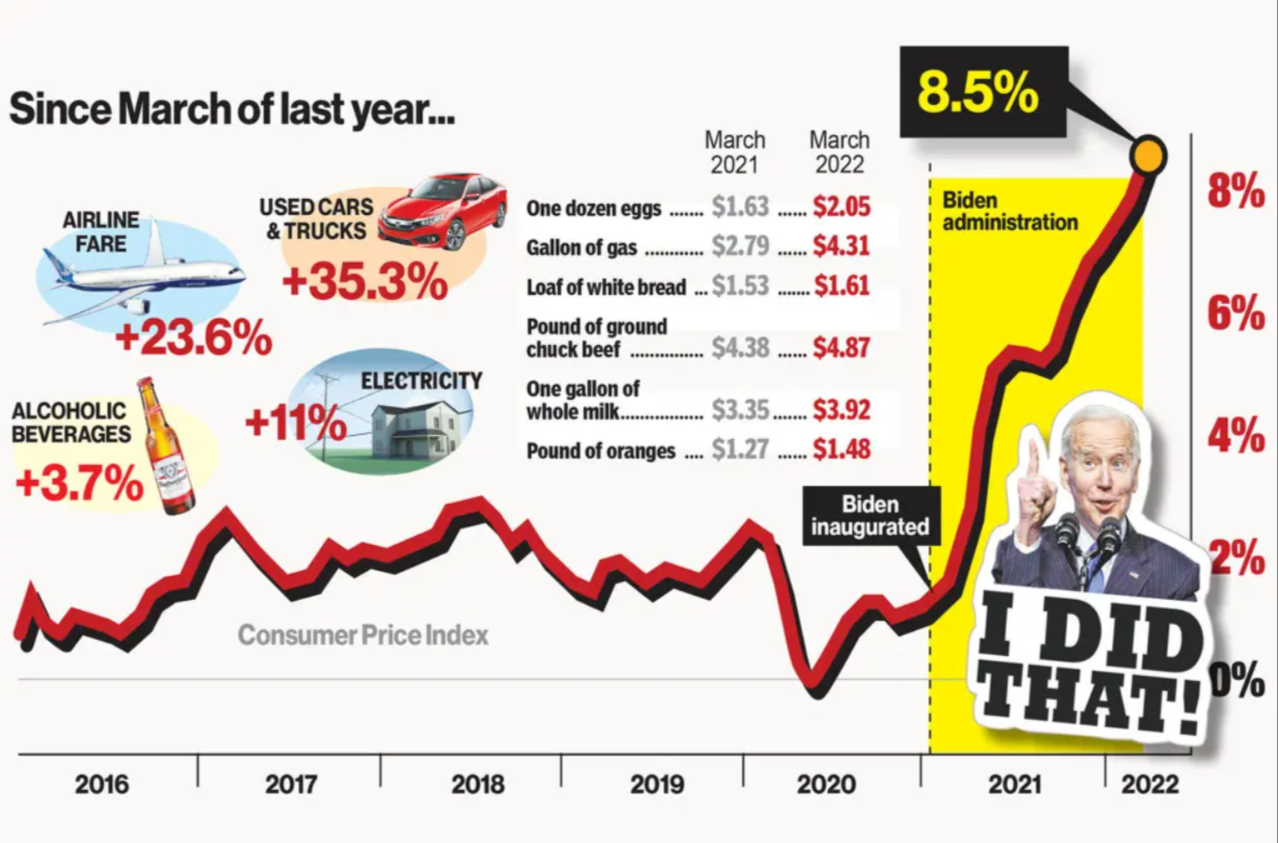

(ThyBlackMan.com) Inflation, rising consumer prices, skyrocketing gas prices — we hear about these topics every day. We feel the effects of these economic buzzwords, they cut like scalpels into our wallets, bank accounts, and 401K plans. These bad economic times mean we don’t get the cool new gadget we’ve been saving for, the kids don’t get the awesome vacation at Disney this year, or we’re dining on potatoes and green beans for the week. Maybe, Biden’s dismal economy means another half decade before retirement.

Last Friday, the always glib, unprepared, and painfully shallow White House Press Secretary Karine Jean-Pierre was questioned by Peter Doocy about the Biden administration’s response to inflation. Jean-Pierre claimed that current out of control inflation is the result of COVID and the war in Ukraine — laughable. Jean-Pierre further beclowned herself by claiming inflation is a global issue, also the result of COVID and the Russian war on Ukraine.

The May inflation rate spiked to 8.6%, the highest increase since 1981, and hovers at a 40 year high. However, if we calculate inflation the way we did in 1990, the current inflation rate is closer to 15%.

Inflation isn’t really a measure of how expensive things are. It’s a measure of how the value of the dollar has declined. That pound of bacon costs you twice as much because the dollar is worth far less than it was two years ago. There are other contributing factors to the high cost of bacon, but inflation exacerbates the Biden bungling of supply chain problems, and his intentional energy cost increases — the pain you feel at the pump is all part of Biden’s delusional green initiative.

But during Friday’s press brief, Doocy demolished Jean-Pierre’s silly response by rattling off a list of countries with far lower inflation numbers. Japan’s is particularly interesting, with the April core inflation rate coming in at a mild 2.1%. Biden and his mouthpiece are gushing misinformation in a pathetic attempt to distract from their demolition of the currency, national security, and American energy independence.

Democrats are obsessed with inflating the currency simply because it makes the national debt cheaper to service. Inflation is a bit of a misnomer — it’s a measure of decrease in value, not an increase of cost. The U.S. dollar is a fiat currency, meaning the paper money that is currently in circulation has zero inherent value. If you take out a dollar bill and examine it closely, you’ll find it’s printed with the phrase “the full faith and credit” of the U.S. government. That simple phrase, almost universally overlooked, means there is no store of value behind U.S. currency. In 1971, Richard Nixon decoupled the U.S. dollar from gold. Simply put, before 1971 you could, theoretically, exchange a dollar bill for a dollar’s worth of gold. This kept U.S. currency resistant to inflation, but posed a massive challenge to the development of the modern statist structure.

Most democrats and big government republicans idolize the economics of John Maynard Keynes because he provided an economic justification for debt and the expansion of fiat currency. In fact, Keynes viewed government debt as essential to the progress of the bureaucratic state. Only a fiat currency and perpetual national deficits can provide a financial structure capable of supporting the welfare state. Billions can be printed out of thin air and redistributed to favored special interests. With the decoupling of hard currency, like gold, which is rare and difficult to mine, from fiat money war, social programs, and pork spending all become possible just by keeping the printing presses running — future generations be damned.

Obviously, at some point, the U.S. government will print more money than the economy can sustain. More dollars chase fewer and fewer resources and create a cataclysm of inflationary forces that result in dollars becoming nearly worthless. But it’s not production that’s the culprit, it’s money creation.

Weimar Germany experienced out of control inflation that resulted in the collapse of the currency. It gave Adolph Hitler his golden opportunity. With the collapse of the German Papiermark, citizens were forced to fill wheelbarrows full of nearly worthless fiat currency to buy loaves of bread. Hitler stepped into the power, and positioned himself as Germany’s savior. The German people moved to desperation, lifted Hitler into power and the rest is bloody history.

We’re currently being governed by Democrats who have their collective feet pressed to the fiat currency gas pedal. In reality, the Federal Reserve can do little to forestall the coming economic disaster. In fact, thoughtful economists posit that in order to effectively deal with current inflation rates, the Fed would have to increase interest rates immediately by 8% or more — a politically untenable action.

Inflation is really a product of the Fed increasing the money supply by buying financial assets. It buys treasury notes by creating credit out of thin air. It replaces the treasury notes with extended credit, giving lending institutions more money to lend. Coupled with a low federal funds rate, money is poured into the economy. All of this manipulation, which results in the whipsawing effect of inflation and deflation, would be impossible without a purely fiat currency — and it’s Biden’s Fed that has stoked the raging inflation fire.

Inflation is also a product of stimulus. The U.S. Treasury owns the keys to the printing presses and when the Democrats press the “stimulus button,” billions roll into the economy. The root of the problem is the statist love affair with debt.

A wise man once said, “the borrower is servant to the lender.” What’s true for individuals is also true for a nation. The dollar has remained tenable since it’s the world’s reserve currency. But how much longer will that remain true? China has stated it intends to assume that role. If China succeeds, then the collapse of the dollar will be certain.

What is also certain is that Biden is a debt mongering Keynesian to the core, and will transition America into servitude.

Written by John Nantz

Official website; https://twitter.com/TheJohnNantz

Leave a Reply