(ThyBlackMan.com) “U.S. state and local employee pension plans are in trouble — and much of it is because of flaws in the actuarial science used to manage their finances. Making it worse, standard actuarial practice masks the true extent of the problem by ignoring the best financial science — which shows the plans are even more underfunded than taxpayers and plan beneficiaries have been told.” http://www.marketwatch.com/story/why-your-states-public-pension-plan-is-in-a-much-bigger-hole-than-you-already-fear-2016-08-16

While the corporate media and US Congress engage in a sham witch hunt for evidence of the nonexistent Russian hacking of the 2016 presidential election, real concerns and problems go unaddressed. Several years ago I had investigative reporter Patricia Kelly O’Meara of the Washington Times on my Internet radio program. Our topic was psychotropic drug abuses against children. She also shared a story she was working on about the insolvency of the Pension Benefit Guaranty Corporation how the rash of giant bankruptcies of the US steel and airlines industries were further depleting the reserves of this quasi-Public entity designed to be the last resort to protect private pensions in cases of company default and bankruptcy.

shared a story she was working on about the insolvency of the Pension Benefit Guaranty Corporation how the rash of giant bankruptcies of the US steel and airlines industries were further depleting the reserves of this quasi-Public entity designed to be the last resort to protect private pensions in cases of company default and bankruptcy.

Her reports revealed that big companies were deliberately off-loading their pension obligations onto the PBGC to be born by the US taxpayers. They were keeping the funds they collected for and from their employees and claiming they didn’t have the money to honor their pension obligations. The BPGC was forced to step in and provide at least some pension benefits to the retirees although in most cases it was not what their Defined Benefit Retirement agreements called for!

As a result of her articles Congress took action to replenish the PBGC fund so it was in better condition than prior to her revelations. However due to the 2008 crash the fund is now seriously underfunded again. “The government’s pension insurance company, the Pension Benefit Guaranty Corporation (PBGC), is broke. Because its creditors can’t demand their money immediately, it won’t have spent its last dollar for ‘a significant number of years’ yet (maybe ten) — but its liabilities of $164 billion are nearly twice its assets of $88 billion: there is no way it can honor all its obligations.” http://www.realclearmarkets.com/articles/2016/07/26/who_will_pay_for_the_pension_benefit_guaranty_corporations_huge_losses_102279.html

There is a pension crisis in America that is metastasizing and roiling out to the point hundreds of public and private pensions are at risk for collapse leaving current pensioners in a lurch and future retirees at risk for destitution due to reduced benefits or no benefits at all!

Every once in a while the media reports on a fund that is in fiscal difficulty like the Teamsters Union fund. https://www.thenewamerican.com/usnews/congress/item/24970-teamsters-pension-plans-seek-massive-cuts-to-retirees-to-stay-solvent

What we are not being told is that so many municipalities, counties states and company pensions are in deep trouble due to decisions the CEO,s CFO’s, mayors, councils, managers, governors made negotiating contracts with unions, and how their funds were managed.

For public pensions mayors and governors opted not to make the needed contributions to the funds. I do not have the space to provide all the data so go to https://ballotpedia.org/Public_pension_crisis, http://www.marketwatch.com/story/collapsing-pensions-will-fuel-americas-next-financial-crisis-2017-03-14 and http://thehill.com/blogs/pundits-blog/finance/325564-the-pension-crisis-will-be-americas-next-financial-crisis to see just how precarious the US pension system both public and private really are.

What can we do? Ask questions, raise issues with your elected officials, your union reps and employers. Get involved, attend meetings, read the relevant materials your union or pension fund send you, do your own research and become more familiar with the issues.

The fiscal and related pension troubles in Detroit, Chicago, South Carolina and California are not isolated occurrences, they are the very reality most of us will face sooner or later. When Detroit was going through its bankruptcy proceedings several years ago, I admonished readers to keep an eye on how they resolved the pension issues.

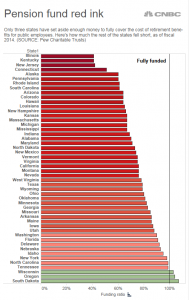

Now the state of Illinois is in deep trouble, please pay attention to what happens with their budget and pension contributions. These same fiscal crisis are being faced by cities, counties, states and nations. Here is some additional information on various states, their pension status and overviews of what is being called “the pension tsunami”. More than likely regardless of where you live, your state is included. Enlarge the graph at the top of this post and review the following material and act intelligently: http://www.welovecostarica.com/the-unfunded-pension-tsunami-is-rapidly-gaining-momentum-the-us-public-pension-system-is-mathematically-guaranteed-to-crash/, http://reason.org/news/show/the-public-employee-pension-crisis and https://www.weforum.org/agenda/2017/05/5-things-you-need-to-know-about-the-global-pension-crisis/

Written by Junious Ricardo Stanton

Official website; http://fromtheramparts.blogspot.com

Leave a Reply