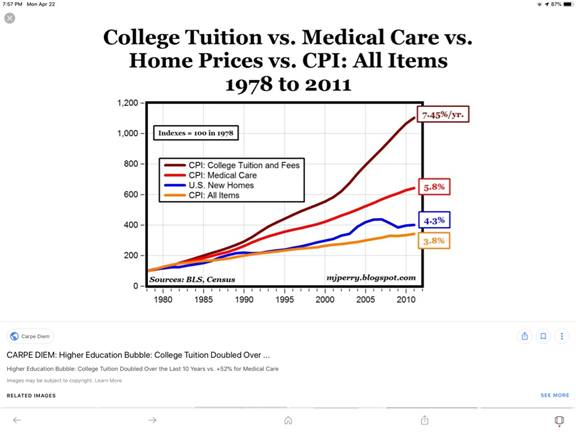

(ThyBlackMan.com) For the past ten years, inflation has averaged less than two percent with two exceptions: Health Care (~six percent) and College Tuition (~eight percent). An eight percent college inflation rate means the cost of college doubles every nine years. Think of it this way, if your 18-year-old daughter enters a State University in 2019, you/she will pay over $100,000. If nine years later your nine-year-old son decides to attend college, you/he will pay over $200,000. College tuition today, is an unsustainable cost for the average American student and family!

HAS COLLEGE TUITION BECOME A PONZI SCHEME?

Recently at least 60 “Richie Rich” type parents illegally bought and paid for college admission for their spoiled darlings. I hate to the bearer of bad news, this has been going on, disguised in various ways for decades! While this is both illegal and unethical, we have a much bigger problem. We have convinced majority of Americans, our youth are doomed to poverty and failure without a four-year degree. Then we burden both parents and teenagers with tens of thousands, sometimes hundreds of thousands of debt, as they enter the work world.

First, we all know of Billionaires (Bill Gates, Steve Jobs- Family, etc.) and Everyday Millionaires that do not have four-year degrees. More than half of U.S. Millionaires do NOT have a four-year degree. I have met several! So where did this myth that success in America requires a college degree come from? Why the College industry, of course.

Who is putting the pressure on our youth- Parents; Guidance Counselors (clearly with little Financial Literacy); Useless (in other words ALL) politicians preaching free college for all; Lobbyists and Employers who still insist on only interviewing people with a four-year degree to be a Starbucks Barista!

While we preach the importance of a four-year degree, we allow the cost of tuition to increase faster than inflation, health care, real estate, food, and energy – heck faster than everything else we actually need!

College has become so expensive because we provide unlimited free money in the form of loans, for any degree, regardless of how useless that degree is, and encourage our youth and parents that starting your work life with over $100,000 of debt is the NEW NORMAL. The “Richie Rich” parents and unfortunately everyday Americans are over valuing a four year degree and especially overvaluing the big name schools such as Stanford, that today charges ~$76,000 per year. Remember the average student spends five or more years in college, so that beautiful gold trimmed Stanford, Harvard, Yale, etc. degree will cost you about $400,000. Heaven help you if you attend a big name university for your MD, Law, PhD degree! With an 8% inflation rate that will run you another ~$800,000. Sustainable? Forget sustainable, is it even POSSIBLE?

A CRITICAL CULPRIT- THE LACK OF FINANCIAL LITERACY

How much financial literacy or for that matter, common sense does the average 17 year old have? Based on my own lack of knowledge at that age, I would say pretty close to ZERO.

It is a disgrace that colleges and so many others have brainwashed Americans into believing that kids need to borrow $100,000 or more to get any degree they can spell.

Right now we have a growing economy and there are over seven million jobs available; most of which DO NOT require a four-year-degree. These jobs require specialized education, typically taking two years or less. Unfortunately, we are now obsessed, not with education, but credentialing. It is not just the kids holding the debt, but parents and grandparents. Last week, I read an article where a son went to Howard and got his BA in Political Science. Now, he and his 67 year old mother jointly owe ~$100,000! This is criminal on the part of the schools and a lack of financial literacy on the part of the kid and his Mom! By the way a Political Science degree makes it tough to find a job and the average starting pay depending on GPA is about $35,0000.

We have created THIS MESS!

Why are colleges allowed to increase cost two to three times inflation? Are graduates getting job offers equivalent to eight percent increase each year? HELL NO! Colleges have entered Bernie Madoff – Ponzi Scheme territory with these unethical practices. We must start to hold colleges accountable for these outrageous tuition increases they push out each year (LIKE CLOCK WORK).

RULES OF THUMB ON ACCEPTABLE LEVELS OF TUITION DEBT

So how much should you borrow? Your MAXIMUM TOTAL student loan debt at graduation should be less than your first year starting salary. So for a BA in Political Science your maximum loan should be less than $35,000. A better rule of thumb the ideal total student loan debt at graduation is less than 50% of your first year starting salary. So that same student getting a BA in Political Science is capped at $17,500. This means in five years, applying 10% of your salary to your loans you are debt free and able to go on with your life.

THE NEED FOR GOVERNMENT TO STEP IN

I hate new regulations as we have too blasted many today. But clearly the American University system will NOT do the right ting without government intervention. Colleges and greed have sold the American people a four-year-degree is required for success. Because of Americans lack of financial literacy neither the parents or students recognize this is simply untrue.

While that Political Science degree is starting at $35,000 {IF you can find a job}, Electricians, Plumbers, CAD Operators, Robotics Technicians; Drone Pilots, Programers, App Designers, and countless more fields start you at $75,000 or more with a two year or less education, typically at an inexpensive community college. Majority, not all colleges and universities have turned into unethical hogs. “Pigs get fat, hogs get slaughtered.” Or in this case the hogs are slaughtering the American families with excessive debt.

ELIZABETH WARREN SAYS YOU SHOULD

PICK UP THE COST TODAY’S YOUNG ADULTS HAVE RUNG UP

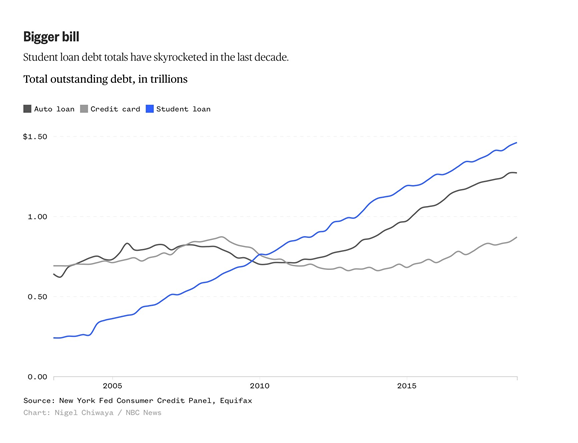

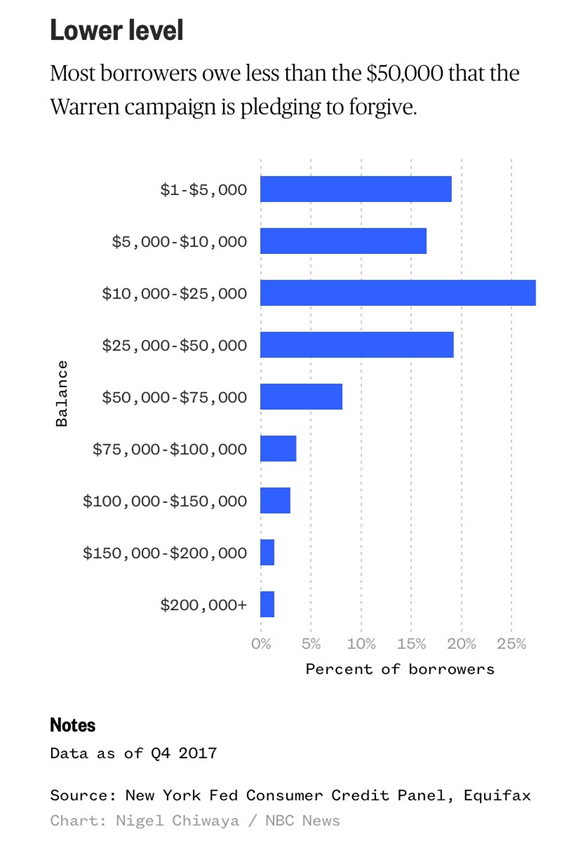

Elizabeth Warren is now proposing the taxpayer (look in the mirror) pick up part of the ~$1.5 TRILLION DEBT tab, by paying the first $50,000 in college debt per student. As the above chart demonstrate that will totally pay of the loans of majority of Americans, relieving them of ALL ACCOUNTABILITY for bad decisions.

This is not just a bad idea it is a STUPID idea.

I follow Dave Ramsey and routinely see people pay off six figure debts in relatively short periods (3-7 years) of time. What do we tell those people, if we pay off others college debt? Thank you for being honest enough to pay your debt and frugal enough to pay it off early, but we are gong to pay the debts of your peers? What is the next reparations proposal, college loans?

CONCLUSION

I support and respect further education, including trades and crafts, but NEVER at any cost. Both my parents were educators. Both my daughter and I have college degrees. In fact my daughter is studying for her second degree while working a full time job.

But all Americans do NOT need a four year college degree. In this country we have boundless opportunities to work hard, spend less than we make, save and invest and become wealthy without a college degree. The choice is yours; utilize financial literacy to make the right decisions for yourself.

ROOT CAUSES OF THE CRISIS IN COLLEGE COST

- The greed and unethical management of colleges and universities.

- The willingness to lend anyone tens of thousands of dollars, REGARDLESS of the poor Return On Investment.

- The lack of financial literacy of the average high school students.

- The lack of financial literacy of majority of High School Guidance Counselors and Parents

COMMON SENSE SOLUTIONS

- Serve in the U.S. Military. The U.S. government paid for my Dad’s two college degrees.

- If you cannot afford out of state tuition, STAY in state! This is not an opportunity to travel the country and party, but an opportunity to better yourself. Opting for a four-year public college in your home state over a private college will save you over $100,000 in tuition. HELLO-Anybody Listening?

- Live at home and commute to college will eliminate the cost of a dorm room — which, for the 2018-2019 academic year, was between $11,000 and 13,000.

- Choose a less expensive school. I have watched two young people opt for mor expensive schools neither they or their Mom’s could afford.

- Attend Community College for two years, than transfer to a State University.

- Four years maximum. Completing your studies on time will help you avoid having to pay for extra classes or semesters, thereby adding to your costs/debts. To that end, aim to choose a major relatively early on during college, and spend your first year knocking out core requirements so they are not hanging over your head later on.

- PLEASE select a major that will GET YOU A JOB allowing you to pay off any debts accumulated. If you want to be a professional photographer, which was my dream job many years ago, there are plenty of inexpensive on line courses to improve your photography skills.

- Get a job while in school! YES YOU CAN!

- If non essential stuff is getting in your way of finishing your degree in four years or less – GIVE IT UP! Give up the pledging, sitting on your behind getting drunk, etc. Study and Work! Try it! Many schools offer work-study programs that will set you up with a job on campus, but you need to apply in advance of the semester. Research it.

- You may have to take on some debt for your education. Limit your student debt to the absolute minimum and apply for federal loans only. The interest rates associated with federal loans can be substantially lower versus private lenders,,

- ONE LAST THING – Build your FINANCIAL LITERACY BEGINNING TODAY!

WHAT THE FEDERAL AND STATE GOVERNMENTS CAN DO

- We must teach financial literacy in 100% of High schools. We are expecting 17 to 18 year old kids to make financial decisions that will impact them for the rest of their life. Only 17 states require ANY financial education in high schools. Believe me a financial literacy class would have helped me a lot more than Shop and Choir!

- Colleges must show the probability of finding a job for each major based on GPA and the average US starting salary range for the major. Clearly demonstrate the Return on Investment!

- The government college loan lender must limit the loans to a percentage of first year starting salary based on the degree. So a doctor can borrow more than a Poetry Major.

The Most Important Trump Proposal You Missed So Far This Year

- Reorient the Accreditation Process to Focus on Student Outcomes” – Accreditation is supposed to give the public confidence that colleges meets the highest education standards, and is required for a school to qualify for federal aid. However, in 2016 the Accrediting Council for Independent Colleges and Schools continued to accredit Corinthian Colleges even after shady loan practices had been uncovered and right up until their bankruptcy, calling the entire system into question. The White House is looking to make accreditation more meaningful.

- “Increase Innovation in the Education Marketplace” – The language for this proposal is not clear, but it sounds like the White House wants to encourage schools to work more closely with the private sector to provide job-specific education.

- “Better Align Education to the Needs of Today’s Workforce” – The White House is proposing to improve access to apprenticeship programs and on-the-job training models, including wider access to Pell Grants for students looking at credential, certification, and licensing programs. It would also widen Federal Work Study programs to include more practical off-campus jobs.

- “Increase Institutional Accountability” – Schools accepting federal funds would have to share in the burden of unpaid student debt. How it would work is unclear, but the goal is clearly to improve job placement and push students towards careers with higher probability for loan repayment.

- “Accelerate Program Completion” – Graduating earlier means lower overall costs, but according to the National Center for Education Statistics only 60% of students complete a bachelor’s degree with six years of attending. The White House is proposing additional adoption of “prior learning assessments,” which take into account prior work, military, and educational experience students may have gained before college and applying academic credit. This way someone with four years of military service could potentially graduate from college earlier, testing out of some required academic credits.

- “Support Historically Black Colleges and Universities” (HBCU’s) – The White House proposes that “Congress should make permanent the President’s Board of Advisors on HBCU’s and the Interagency Working Group responsible for improving the capacity of HBCU’s to continually improve the identity, visibility, distinctive capacity, and overall competitiveness of HBCUs.”

- “Encourage Responsible Borrowing” – The White house is proposing straight caps on Parent and Grad PLUS loans, limiting the amount that can be borrowed while simultaneously providing additional guidance and required counseling to borrowers.

- “Simplify Student Aid” – This would consolidate the five income-driven repayment plans into one, capped at 12.5% of discretionary income, extend student loan forgiveness, and allow the Dept. of Treasury to automatically provide tax data to the Dept. of Education.

- “Support Returning Citizens” – The White House is asking Congress to provide financial aid specific to prisoners eligible for release to improve employment rates.

- “Give Prospective Students More Meaningful and Useful Information about Schools and Programs” – Currently the data available to students through the Department of Education is at the institution level, such as tuition costs and graduation dates. The White House is looking for more granular data so students can better compare programs across schools.

To follow my daily posts on Instagram click: instagram.com/wealth_building_powers

ALL COMMENTS, RECOMMENDATIONS AND FEEDBACK ARE WELCOME. SEE BELOW LEAVE A REPLY SECTION.

PLEASE SIGN UP TO FOLLOW THIS BLOG by clicking AT THE TOP OF THE HOME PAGE: FOLLOW BY EMAIL

ALL LIKES ARE GREATLY APPRECIATED!

DISCLAIMER

I am a proud nerd (my beautiful wife and daughter told me so) investment and finance blogger, with University Rutgers, MBA and Harvard University, Advanced Management education.

I started my first business at ~13 years of age. I am a successful investor in equities and real estate and happy to share my personal finance and investment lessons learned with you. I am NOT however, a licensed financial advisor. Please do not construe my suggestions on this blog, as recommendations for your personal situation. For individual finance advice please seek your own licensed CPA or financial advisors.

Staff Writer; Styron Powers

One may visit this brother over at; Powers Investments Management and also connect via LinkedIn; S. Powers.

Leave a Reply