(ThyBlackMan.com) One consistent piece of economic folklore has consistency hinged around the importance and value of owning your own home. This assessment, however, isn’t entirely incorrect, and it certainly deserves more thought. A recent article in the Wall Street Journal compares the saving/investing habits of the top 1% of Americans vs. the rest of us, and reveals some interesting information.

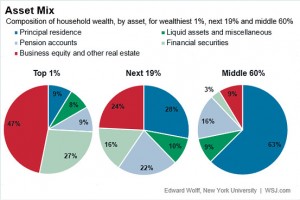

Edward Wolff, an economist at New York University, provides evidence that members of the top 1% are far less likely than the middle class to lock up the majority of their wealth in the value of their homes. In comparison, the top 1% put about 9% of their wealth in their home, vs. 63% for the middle class. That difference is huge.

Wolff, studying data from the Survey of Consumer Finances, did deeper comparisons of the top 1% to everyone else. To make it to the top 1%, you have to have a net worth at least $7.8 million dollars. This would include your assets, minus your liabilities. Putting aside the political stigma of being a member of this group, analyzing their economic choices might provide clues on how the rest of us can thrive in a capitalist society.

What Dr. Wolff found is that for the top 1%, nearly half of their gross assets are in unincorporated business equity and other real estate. They have another 27% in financial securities, such as stocks, bonds and mutual funds.

Member of the middle class, however, puts about two-thirds of their wealth into a primary residence.

Wolff also studied the upper middle class. According to Wolff, the upper middle class (aka “the next 19%”) consists of those with a net worth greater than $400,000 and less than $7.8 million. Wolff finds that this group also follows a similar trend, investing more of its wealth into businesses than the middle class, but they have far less business investment than the top 1% (the chart below breaks it all down for you).

The upper middle class also keeps a great deal of its wealth in pension accounts, including IRAs, 401ks, etc. These assets are typically linked to the stock market, which has done quite well historically. Those who aren’t invested in pensions, a home or a business tend to struggle the most, and that’s not where you want to spend your life, at least not in America.

You can read more of the study here.

Here are the Financial Juneteenth lessons from this information:

1) The recent recession hit the housing market the hardest, so the middle class and poor have not recovered as quickly as major corporations. If you’ll notice, Wall Street has been hitting a new high nearly every year, so people who own stock have seen their wealth increase. The best thing to do, at this point, might be to learn how to invest in the stock market. We have an inexpensive class on this blog which explains how to get started with the stock market, and it doesn’t cost much money to begin.

2) I’ve personally found that these results apply pretty accurately when seeking to grow my own portfolio. I’ve earned far more money owning my own business than by owning a home (literally with Return on Investment (ROI) regularly exceeding 75% per year, which is much higher than the stock market or anywhere else), and also, the rise in the stock market has had a powerful impact on my retirement portfolio as well. So, the basic order of things (at least right now) in terms of ROI is 1) Owning your own business or a piece of someone else’s, 2) Investing in the stock market through either a retirement account or direct investment and 3) owning your own home.

3) Unlike other financial assets, a home has value that goes beyond putting money in your pocket. Most importantly, it’s a good place to live. You can’t live inside your stock portfolio, so this is the kind of non-financial benefit that a study like this might miss. Also, wealthy Americans are not as inclined to spend as high of a percentage of their income on their homes as the rest of us. For example, Oprah’s house might cost $100 million dollars. Even if she owns the biggest house in the state, it’s still only a fraction of her net worth.

4) The wealth-building opportunities from business ownership are actually GREATER in the black community than anywhere else. While African Americans struggle with a lack of access to capital, there are quite a few under-developed business markets in the US, Africa and the Carribean. I highly suggest getting in on the ground floor for some of these amazing opportunities. In the near future, we are going to do a joint series with a group on how to make money in Africa. I hope you’ll join us.

5) Learning from the top 1% doesn’t mean adopting the value systems of the top 1%. Your goal in learning the power of money should not include learning to worship money. At the end of the day, mastering wealth means mastering freedom. A billion dollars can be spent buying Bentleys, or it can be spent educating children. Money is not inherently evil, for it is the way you use that money which determines if it is a good or bad thing. So, go out and become part of the 1% and then use those funds to better your community. That’s a whole lot more effective than spending your life begging a white guy to give you a job.

Staff Writer; Dr. Boyce Watkins

Dr. Boyce Watkins is the founder of the Your Black World Coalition. For more information, please visit http://BoyceWatkins.com.

Leave a Reply