(ThyBlackMan.com) Sometimes the replies to inquires or questions we ask are profoundly simple. This would be the case concerning my asking a question of Satchel who frequents this site, and regularly makes comments (https://thyblackman.com/2013/09/13/black-unemployment-up-again-at-13/ ). Here is what I said and ask him, “Satchel, I have put before our readers a workable plan to bring not only blacks but the country out of this economic downturn. I have even gone as far as to actually point out to our brothers and sisters the specific benefits of the Davis Deficit Neutral Job Creation Plan ….“Satchel, why haven’t you contributed to bringing this plan out of obscurity through contributing to the billboard campaign offered at http://www.indiegogo.com/projects/491214/wdgi/4313400 ?” His reply was simple and to the point.

I will share it with you. He said, “I believe Social Security Insurance (SSI) is just that. An insurance Policy to Secure a basic living, for people in the United States, who can’t earn a living either by Age or Health.” The implication drawn from his reply was that the “Social Security Insurance program” is fine just the way it is and serves the intended purpose for which it was created. Why bother with, change or adjust this program, especially in the manner that I propose ( http://www.sslumpsum.com )?

In answering Satchel’s reply, I agree that he is completely right, the program and its purpose are just what he said. The purpose of the Social Security Insurance program has not changed since its inception and this is where most Americans really leave the matter. They assume our elected officials are properly administering this program, enabling it to carry out its mission. However, the ability of this program to carry out its intended mission of being, “An insurance Policy to Secure a basic living, for people in the United States, who can’t earn a living either by Age or Health,” has been severely impaired through the mismanagement of its trust fund assets or better put, the mismanagement of our payroll taxes.

States, who can’t earn a living either by Age or Health,” has been severely impaired through the mismanagement of its trust fund assets or better put, the mismanagement of our payroll taxes.

Payroll taxes are taken out of each working person’s paycheck on a daily basis. The blame for this mismanagement can be laid squarely at the foot of past presidents of the United States and Congressional Representatives. Both Republicans and Democrats see the Social Security program and its official name is the “Old Age, Survivors and Disability Insurance Program – OASDI,” as a liability. It is the Republicans however, who see the program more so as a liability than Democrats. This maybe because Republicans are culpable when it comes to the draining of the trust fund’s cash (https://thyblackman.com/2013/05/02/part-i-there-is-no-money-the-social-security-trust-fund-fraud/ ).

Back in 1983, the federal government under President Reagan realized the then present Social Security Retirement Program was not adequate financially, to handle the retirement of the baby-boomer generation. Through the recommendation of a federal committee formed to examine the problem and come up with a solution, the payroll tax of American workers was raised.

They reasoned this would make the fund financially sound. After all, they reasoned, approximately 30 years of accumulated capital reserves earning a competitive rate of interest should be enough money.

This money should have been placed in a trust account reserved for the use of the baby-boomers. However, the resulting $2.7 trillion dollars or more raised because of this effort, which is what the estimated reserve would be today, was spent primarily to give the wealthiest of Americans tax cuts and finance three wars. What happened to our social security payroll taxes concerning the tax cuts to the wealthy was a federal government sanctioned redistribution of income from workers to the wealthy. Money was literally taken from wage earners through taxes (payroll tax) and given to the wealthy via tax cuts.

The Trust Fund is now in a crisis as acknowledged by the trustees themselves in the Annual Report of 2012, on page 21.

E. CONCLUSION

Under current law, the projected cost of Social Security generally increases faster than projected income because of the aging of the baby-boom generation, continuing low fertility since the baby-boom period, and increasing life expectancy. Based on the Trustees’ best estimate, program cost exceeds non interest income for 2012, as it did for 2010 and 2011, and remains higher than non-interest income throughout the remainder of the 75-year projection period. Social Security’s combined trust funds increase with the help of interest income through 2020 and allow full payment of scheduled benefits on a timely basis until the trust funds become exhausted in 2033. At that time, projected continuing income to the trust funds equals about 75 percent of program cost. By 2086, continuing income equals about 73 percent of program Cost.”

The non-interest income referred to above is current payroll taxes. The difference between the cost of benefits and collected payroll taxes has to be made up from the general revenue of the federal government, because there is no cash reserve! It has long been spent.

The liability when it comes to Democrats has more to do with Mr. Obama than with Congress. Mr. Obama would like see benefits reduced because he realizes with Social Security benefits being paid in part from general revenue, his flexibility in terms of the federal budget is limited.

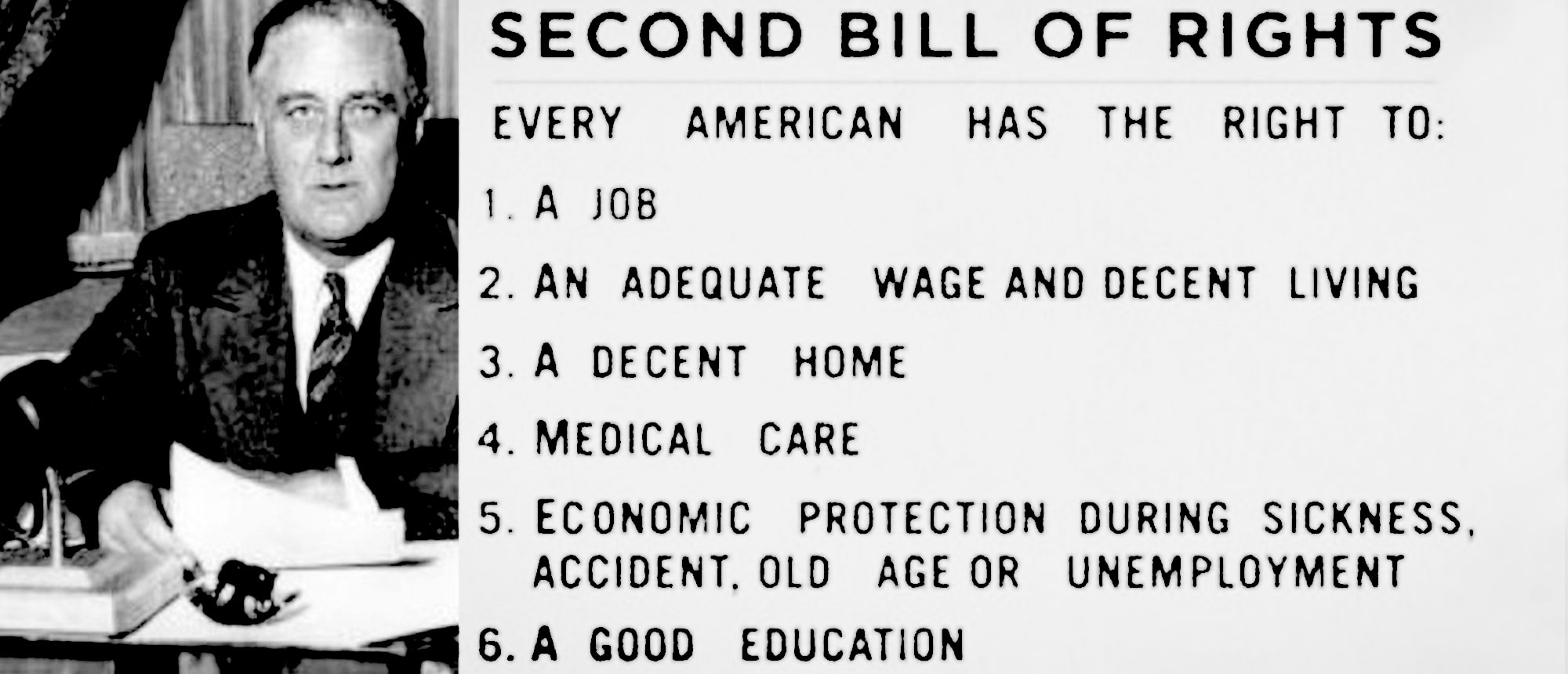

Therefore, what all Americans are faced with is the realization that the Social Security program will cease to exist as we know it and as what Satchel has indicated, a plan for those “people in the United States, who can’t earn a living either by Age or Health.” To save the Social Security program, the program has to be made relevant again. In other words, it has to become indispensable to both Republicans and Democrats if it is going to survive intact. What better way to make the “Trust Fund” indispensable than use it as a means to create needed jobs. What better way to expose the abuses of the “Social Security Trust Fund,” than to adopt and market a logical stimulus plan geared to creating jobs without adding to the deficit?

This approach forces the politicians to clean-up the “Trust Fund” in order to accommodate the job creation plan. You see there is nothing illogical about the Davis Deficit Neutral Job Creation Plan. There is however, a problem with the way the “Social Security Trust Fund” has been and is being managed. I suggest to you that the rehabilitation of the “Trust Fund” will not occur unless the beneficiaries of the “Trust Fund” actively use it.

In other words, Social Security is ours to lose. Without an action plan, it is on the path to irrelevancy. Not everyone under my proposal has to take partial distributions of their Social Security principle. That will be their call. However, the job creation plan guarantees Social Security existence to serve those who are in need in the coming years because it will be actively used to perform a function important to citizens, politicians and businesses. Left alone, and without rehabilitation, it will cease to be a plan for those “people in the United States, who can’t earn a living either by Age or Health.” Join us, and together we can bring the Davis Deficit Neutral Job Creation Plan out of obscurity.

Staff Writer; James Davis

More information about JD and his Deficit Neutral Stimulus Plan Can be founded at http://www.sslumpsum.com.

One may also pick up this “brother” latest book which is entitled; Hey…God’s Talking To You The Study Book.

To Terrance and Robert:

Robert the best way to support me and my efforts would be to support the billboard campaign. This is the best way to move our country forward. It is doable! Political will is what is missing. However, just like you when peo-ple actually become informed, they are able to make a wise decision. Just like you, almost to a person, once becoming informed they recommend the restoration of the trust fund assets. Once an asset restoration program is adopted, partial distributions then will pull us out of the downturn. You see the Social Security Program represent a means through which large amounts of money can be funneled directly to the consumer who represents 70% of GDP. Therefore, we are faced with information campaign … that is bringing information to the American public so that they can make an informed decision.

Terrance, I think the facebook page is a great idea. As the good Lord allows me to raise the funds, to start the billboard campaign, I will make every effort to have a facebook page in the name of the campaign on the day of launch. I am looking for a 501(c)3 organization to sponsor the campaign, thus substantially lowering the cost. I am close to consummating a deal in that regard. It is my intent to see this effort through to its natural end. About the you tube idea, I’ll have to give that more thought. I have however contacted the media and reached out to politicians. The problem that I run into is misinformation – either the fund is broke and you just cannot do such a program as partial distributions, or it can pay out full benefits and there is no need to bother this program. With politicians, especially, misinformation is their friend. They would rather I be silent on this issue. And so it goes. http://www.sslumpsum.com

@ Brother Davis

I’d like to see you get the best chance to prove your plan works, so I’d like to give you some tips on getting the word out. I don’t know what you’ve done, but it won’t hurt to try these marketing ideas if you haven’t already. The free ones are setting up a facebook page with your plan as the name of your page, rather than your name and send it to everyone you know and tell them to do the same.

Twitter as well. Contact the local press in your area who specializes in this area. Contact newspapers, radio,and tv. Put a youtube video together that talks about your plan and what it could do for the country. Setup a radio show on blog talk radio. It’s free and you can make money for your cause too. If that doesn’t work, send out a press release. Based on your message, you should get some pickups. Good luck.

Black Unity means financial independence and happiness

@ James Davis..I know you would agree that Millions of Americans depend on retirement, survivors and disability insurance to provide the funds for their basic survival. There are factions that are campaigning to eliminate the social security fund and put the funds into the hands of millions of Americans to invest as they see fit. This would leave millions of unsophisticated investors open to put their future retirement funds in the hands of Wall Street — the same wall street that was bailed out or cause a collapse of our economy. Rehabilitation is needed to be sure, but should include forbiding the borrowing of future SSI funds and mandating congress make good on the IOUs that SSI is holding and we would be alright.

@ JAMES I hope that you are considering running for office; because everything you are saying make sense ;but I think your solutions can only be implemented from the inside at the congress level.

I read your article’s and comment’s and you seem to have many idea’s and answers you’re the type of person we need to run for office; if you are not running for congress in 2014 please consider; you would get my support!