(ThyBlackMan.com) In a time where job availability is at all-time record lows and people are scrambling to look for work or trying really hard to keep theirs, I felt guiltier than ever for wanting to get out of mine. Day after day, I’d trudge to and from my job, praying that some day soon I could just call it quits, but without necessarily having to call it quits. I definitely wasn’t straddling the fence in my decision – I had both feet firmly planted on the bottom rungs ready to jump, but after years of battling a vicious cycle of chronic job hopping, I knew I had to be a little more responsible than just up and leaving. I, at the very least, owed myself a solid exit plan.

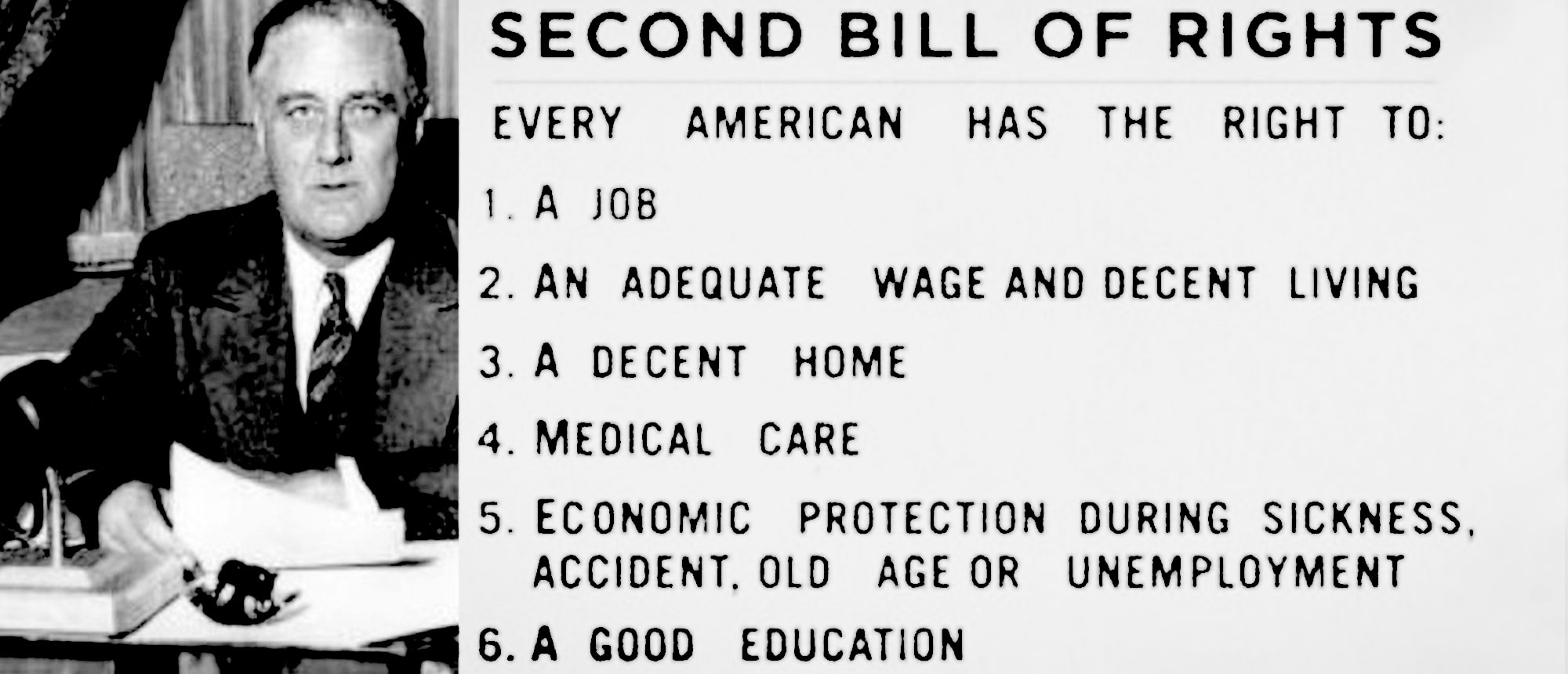

job, I was being an irresponsible citizen who wasn’t contributing to her country’s economic growth and progress. But I was sitting behind a desk! This couldn’t be my life! Devoting the rest of my life, another 40…err uuum…well, yeah…devoting the rest of my life to some employer? I knew there was something more for me.

job, I was being an irresponsible citizen who wasn’t contributing to her country’s economic growth and progress. But I was sitting behind a desk! This couldn’t be my life! Devoting the rest of my life, another 40…err uuum…well, yeah…devoting the rest of my life to some employer? I knew there was something more for me.

Great interview. I follow Melinda on twitter and read her blog often. She is so right about making sure your business aligns with your personal life goals. Another great point she made was to live within your means. Too many people don’t do that.